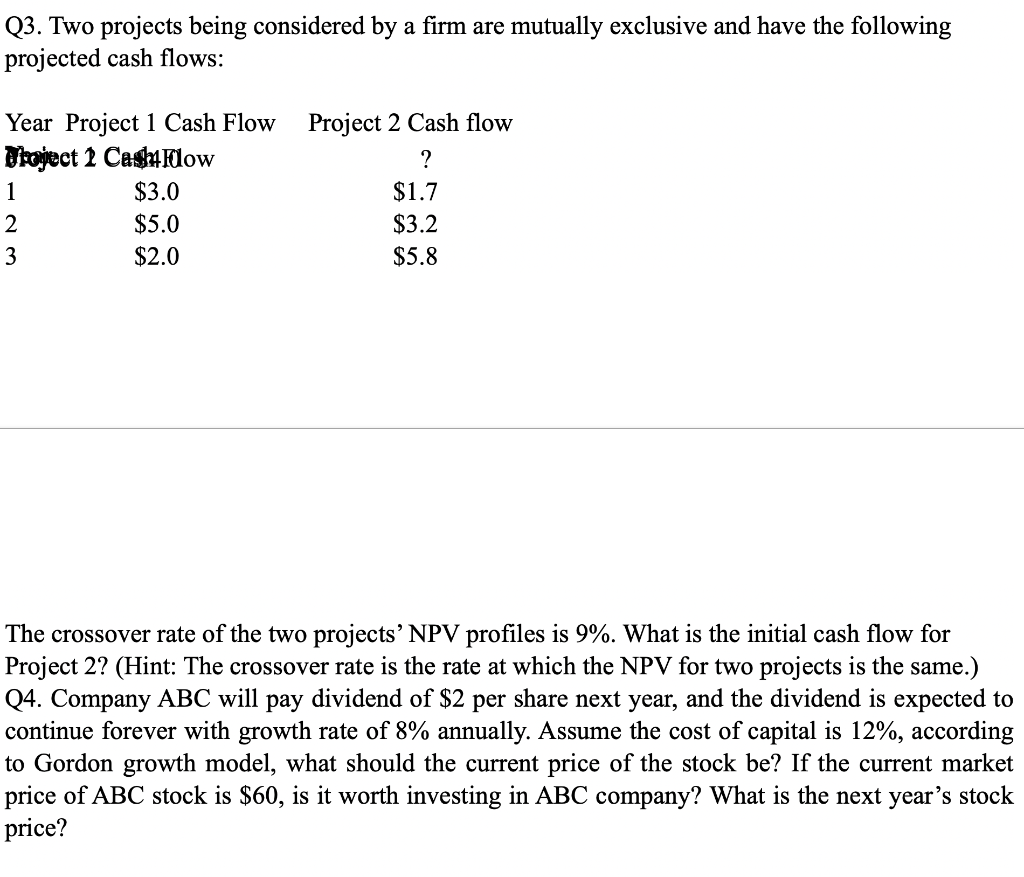

Question: Q3. Two projects being considered by a firm are mutually exclusive and have the following projected cash flows: Year Project 1 Cash Flow Droject 2

Q3. Two projects being considered by a firm are mutually exclusive and have the following projected cash flows: Year Project 1 Cash Flow Droject 2 Cash Flow $3.0 $5.0 $2.0 Project 2 Cash flow ? $1.7 $3.2 $5.8 The crossover rate of the two projects' NPV profiles is 9%. What is the initial cash flow for Project 2? (Hint: The crossover rate is the rate at which the NPV for two projects is the same.) Q4. Company ABC will pay dividend of $2 per share next year, and the dividend is expected to continue forever with growth rate of 8% annually. Assume the cost of capital is 12%, according to Gordon growth model, what should the current price of the stock be? If the current market price of ABC stock is $60, is it worth investing in ABC company? What is the next year's stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts