Question: Q3. You are interested in a fully amortizing 3/1 adjustable rate mortgage (ARM) that has monthly payments over its 10-year term. You see a loan

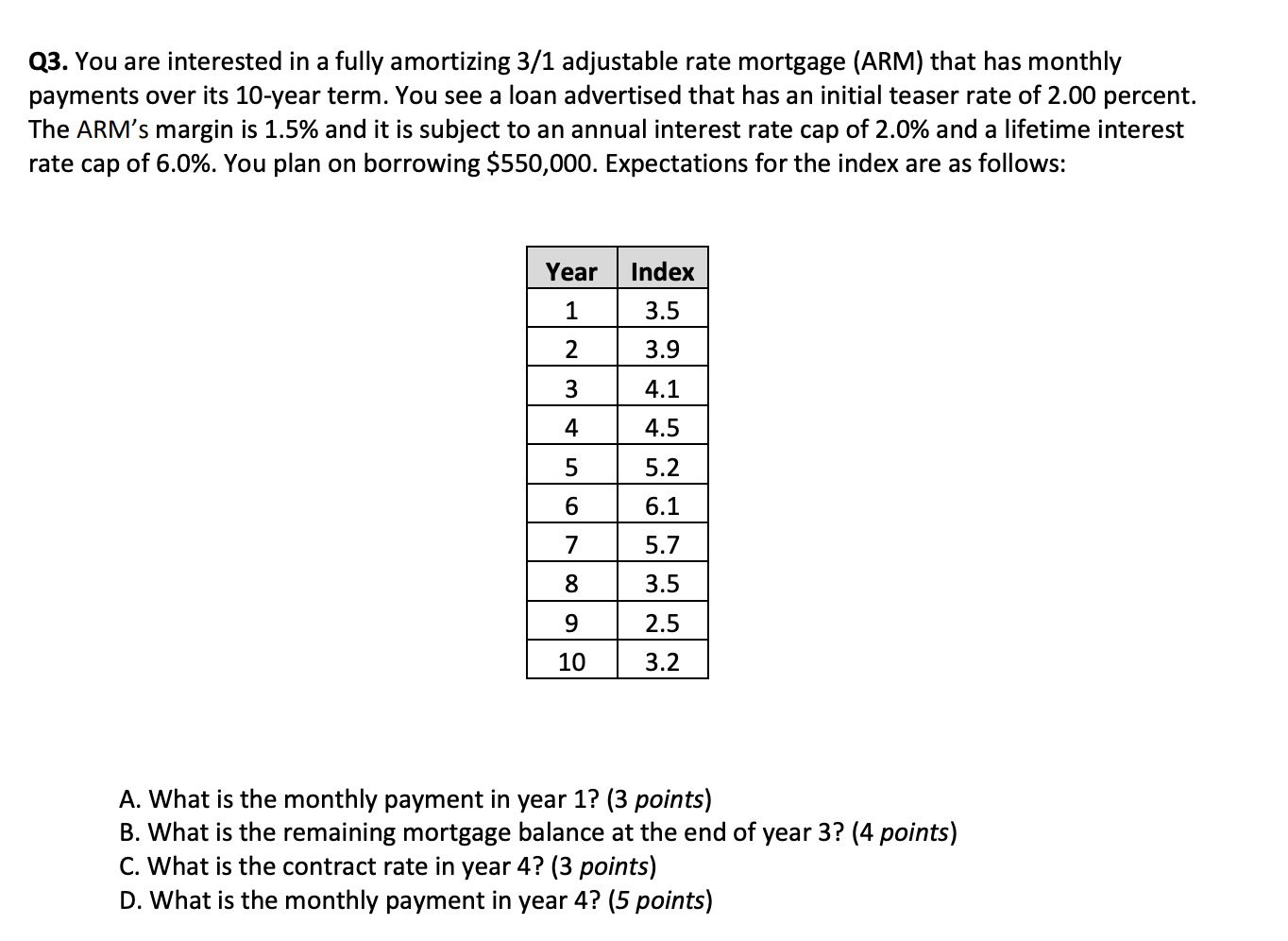

Q3. You are interested in a fully amortizing 3/1 adjustable rate mortgage (ARM) that has monthly payments over its 10-year term. You see a loan advertised that has an initial teaser rate of 2.00 percent. The ARMs margin is 1.5% and it is subject to an annual interest rate cap of 2.0% and a lifetime interest rate cap of 6.0%. You plan on borrowing $550,000. Expectations for the index are as follows: Year Index 1 3.5 2 3.9 3 4.1 4 4.5 5 5.2 6 6.1 7 5.7 8 3.5 9 2.5 10 3.2 A. What is the monthly payment in year 1? (3 points) B. What is the remaining mortgage balance at the end of year 3? (4 points) C. What is the contract rate in year 4? (3 points) D. What is the monthly payment in year 4? (5 points) Q3. You are interested in a fully amortizing 3/1 adjustable rate mortgage (ARM) that has monthly payments over its 10-year term. You see a loan advertised that has an initial teaser rate of 2.00 percent. The ARMs margin is 1.5% and it is subject to an annual interest rate cap of 2.0% and a lifetime interest rate cap of 6.0%. You plan on borrowing $550,000. Expectations for the index are as follows: Year Index 1 3.5 2 3.9 3 4.1 4 4.5 5 5.2 6 6.1 7 5.7 8 3.5 9 2.5 10 3.2 A. What is the monthly payment in year 1? (3 points) B. What is the remaining mortgage balance at the end of year 3? (4 points) C. What is the contract rate in year 4? (3 points) D. What is the monthly payment in year 4? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts