Question: q35 Choose from the options below increases by more than 4.57%. decreases by more than 11.99%. does not decrease by more than 5.64%. increases by

q35

Choose from the options below

-

increases by more than 4.57%.

-

decreases by more than 11.99%.

-

does not decrease by more than 5.64%.

-

increases by more than 9.65%.

-

decreases by more than 3.94%.

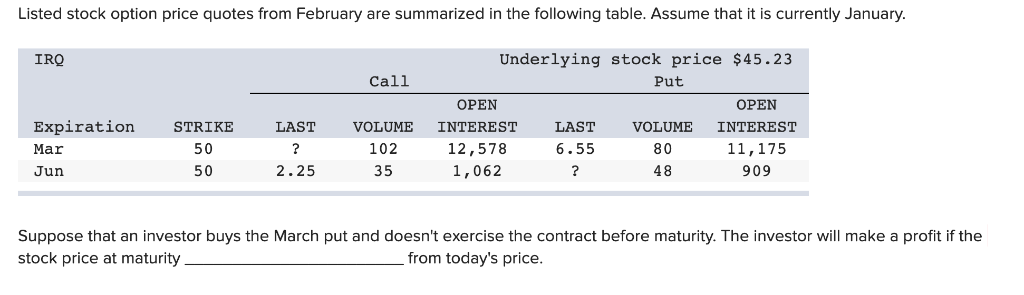

Listed stock option price quotes from February are summarized in the following table. Assume that it is currently January. IRQ Underlying stock price $45.23 Call Put OPEN OPEN Expiration STRIKE LAST LAST VOLUME INTEREST VOLUME INTEREST 102 12,578 6.55 11,175 Mar 50 80 50 35 48 2.25 1,062 909 Jun Suppose that an investor buys the March put and doesn't exercise the contract before maturity. The investor will make a profit if thee stock price at maturity from today's price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts