Question: Q4 (a) Blue Ocean Bhd (OCB), a seaport operator is planning to acquire Fast Mover Bhd (FMB), an haulage transport operator. The acquisition aims to

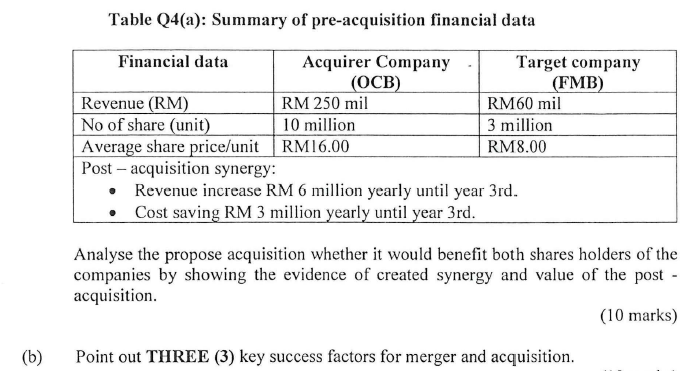

Q4 (a) Blue Ocean Bhd (OCB), a seaport operator is planning to acquire Fast Mover Bhd (FMB), an haulage transport operator. The acquisition aims to intergrate and expand supply chain business of the group. The offer price to acquire the entire shares of FMB is RM 11.00 per share. The due dilligent process has concluded the following bidding summary of pre-acquisition financial data for both OCB and FMB as dipicted in Table Q4 (a). Table Q4(a): Summary of pre-acquisition financial data Financial data Acquirer Company Target company (OCB) (FMB) Revenue (RM) RM 250 mil RM60 mil No of share (unit) 10 million 3 million Average share price/unit RM16.00 RM8.00 Post - acquisition synergy: Revenue increase RM 6 million yearly until year 3rd. Cost saving RM 3 million yearly until year 3rd. Analyse the propose acquisition whether it would benefit both shares holders of the companies by showing the evidence of created synergy and value of the post acquisition (10 marks) (b) Point out THREE (3) key success factors for merger and acquisition. Q4 (a) Blue Ocean Bhd (OCB), a seaport operator is planning to acquire Fast Mover Bhd (FMB), an haulage transport operator. The acquisition aims to intergrate and expand supply chain business of the group. The offer price to acquire the entire shares of FMB is RM 11.00 per share. The due dilligent process has concluded the following bidding summary of pre-acquisition financial data for both OCB and FMB as dipicted in Table Q4 (a). Table Q4(a): Summary of pre-acquisition financial data Financial data Acquirer Company Target company (OCB) (FMB) Revenue (RM) RM 250 mil RM60 mil No of share (unit) 10 million 3 million Average share price/unit RM16.00 RM8.00 Post - acquisition synergy: Revenue increase RM 6 million yearly until year 3rd. Cost saving RM 3 million yearly until year 3rd. Analyse the propose acquisition whether it would benefit both shares holders of the companies by showing the evidence of created synergy and value of the post acquisition (10 marks) (b) Point out THREE (3) key success factors for merger and acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts