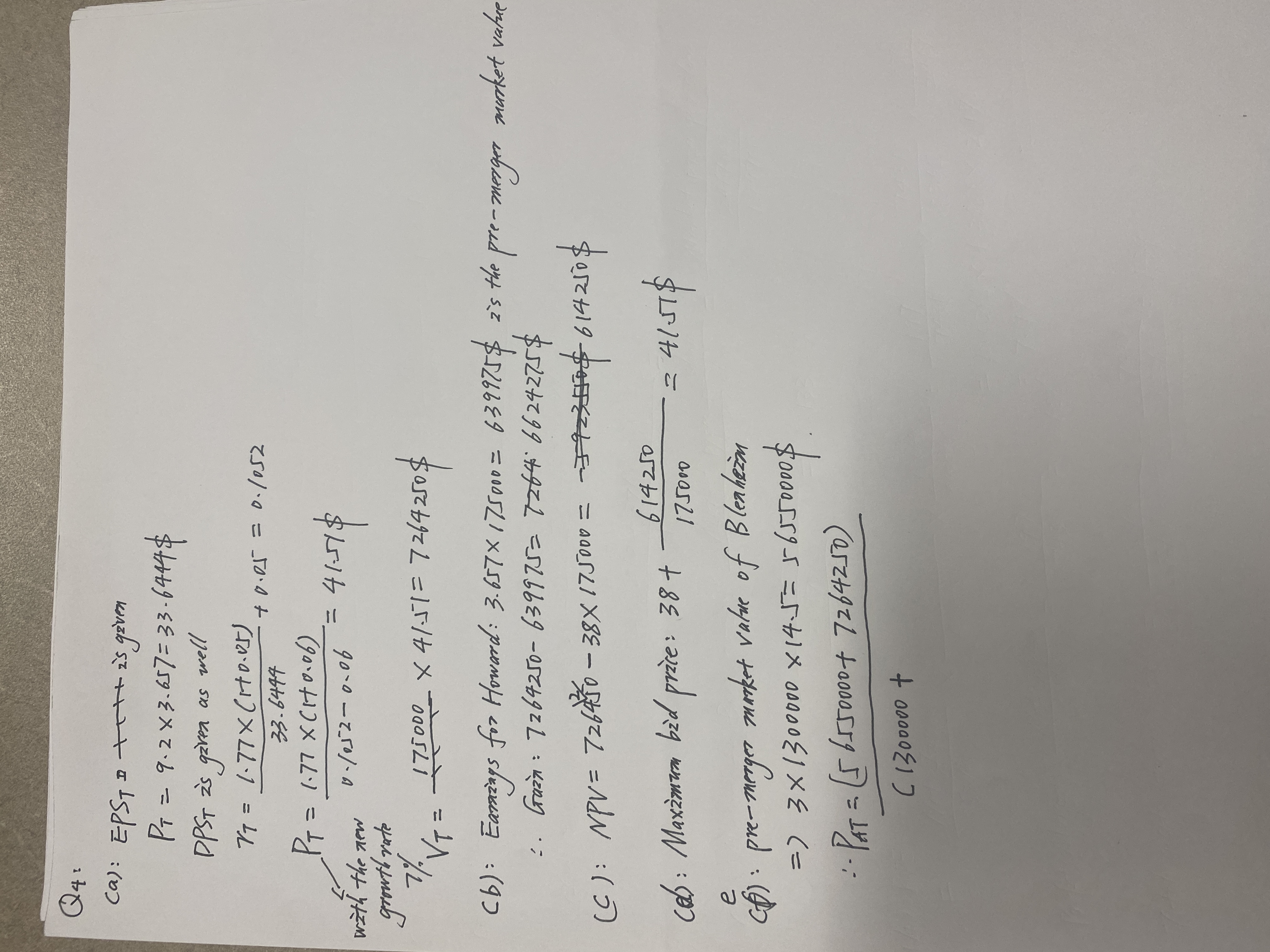

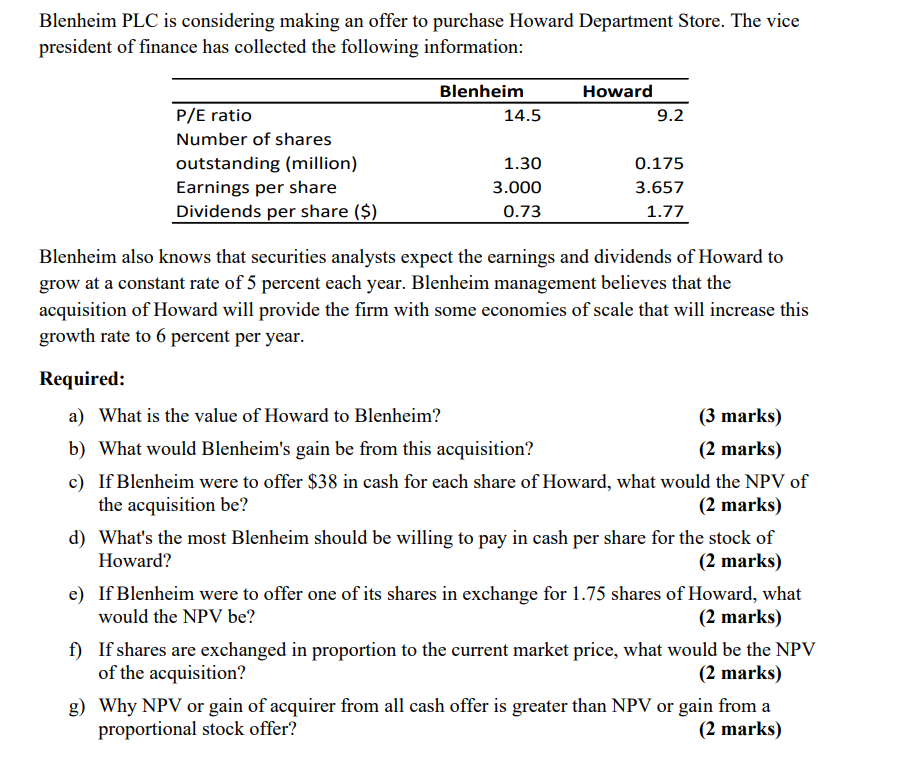

Question: Q4 : ca): EPSTD + ++ 2's given PT = 9.2 X 3. 657= 33- 6444$ PPST 2's given as well VT = 1. 77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts