Question: Q4. Consider now that Olympus stock volatility parameter is increasing from 6 =0.36 to a new level 60.49. All the other parameters remain the same.

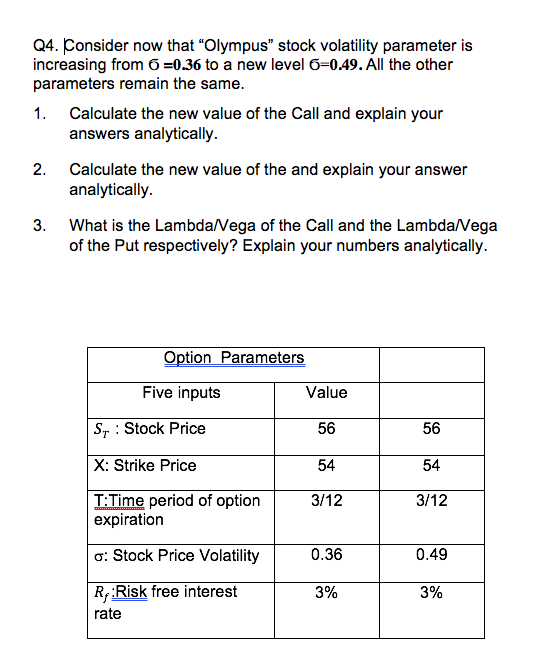

Q4. Consider now that "Olympus stock volatility parameter is increasing from 6 =0.36 to a new level 60.49. All the other parameters remain the same. 1. Calculate the new value of the Call and explain your answers analytically. 2. Calculate the new value of the and explain your answer analytically. 3. What is the Lambda/Vega of the Call and the Lambda/Vega of the Put respectively? Explain your numbers analytically. Option Parameters Five inputs Value Sr : Stock Price 56 56 X: Strike Price 54 54 3/12 3/12 T:Time period of option expiration o: Stock Price Volatility 0.36 0.49 3% 3% Ry:Risk free interest rate Q4. Consider now that "Olympus stock volatility parameter is increasing from 6 =0.36 to a new level 60.49. All the other parameters remain the same. 1. Calculate the new value of the Call and explain your answers analytically. 2. Calculate the new value of the and explain your answer analytically. 3. What is the Lambda/Vega of the Call and the Lambda/Vega of the Put respectively? Explain your numbers analytically. Option Parameters Five inputs Value Sr : Stock Price 56 56 X: Strike Price 54 54 3/12 3/12 T:Time period of option expiration o: Stock Price Volatility 0.36 0.49 3% 3% Ry:Risk free interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts