Question: Q4. Delta and Gamma with Uniform Distribution (20 points) Current underlying price at 100, and you expect price at expiration follows uniform distribution with

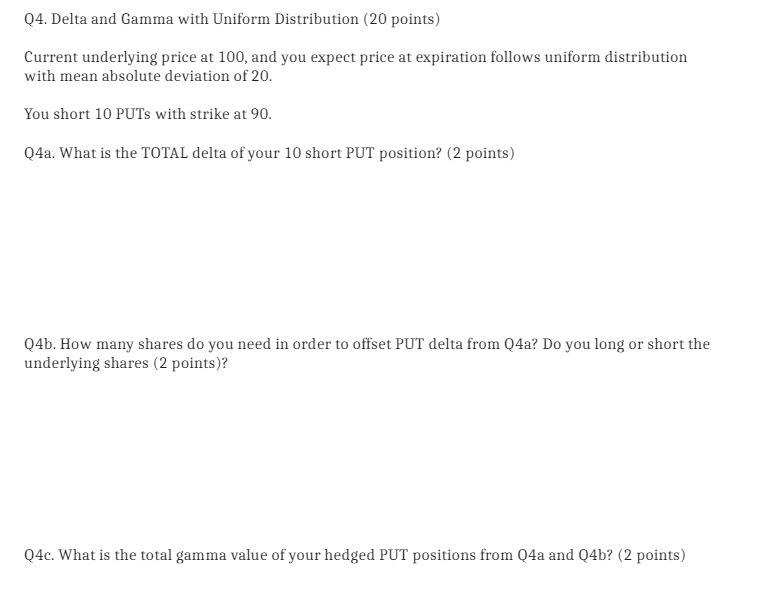

Q4. Delta and Gamma with Uniform Distribution (20 points) Current underlying price at 100, and you expect price at expiration follows uniform distribution with mean absolute deviation of 20. You short 10 PUTS with strike at 90. Q4a. What is the TOTAL delta of your 10 short PUT position? (2 points) Q4b. How many shares do you need in order to offset PUT delta from Q4a? Do you long or short the underlying shares (2 points)? Q4c. What is the total gamma value of your hedged PUT positions from Q4a and Q4b? (2 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock