Question: q4 help me asapppp Question 4 Time lef Question 4 (20 marks) Not yet answered Marked out of 20.00 (a) Lestari Niaga Berhad common stock

q4 help me asapppp

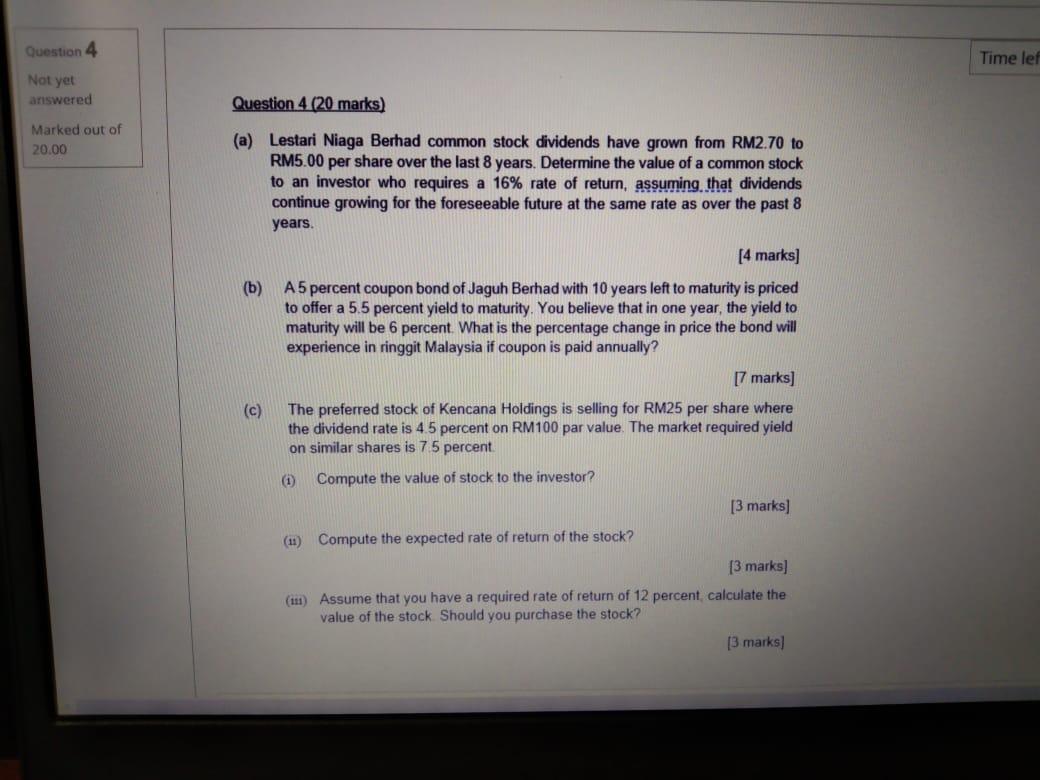

Question 4 Time lef Question 4 (20 marks) Not yet answered Marked out of 20.00 (a) Lestari Niaga Berhad common stock dividends have grown from RM2.70 to RM5.00 per share over the last 8 years. Determine the value of a common stock to an investor who requires a 16% rate of return, assuming that dividends continue growing for the foreseeable future at the same rate as over the past 8 years. [4 marks) (b) A5 percent coupon bond of Jaguh Berhad with 10 years left to maturity is priced to offer a 5.5 percent yield to maturity. You believe that in one year, the yield to maturity will be 6 percent. What is the percentage change in price the bond will experience in ringgit Malaysia if coupon is paid annually? [7 marks] (c) The preferred stock of Kencana Holdings is selling for RM25 per share where the dividend rate is 4.5 percent on RM100 par value. The market required yield on similar shares is 75 percent (i) Compute the value of stock to the investor? [3 marks) (11) Compute the expected rate of return of the stock? [3 marks) (111) Assume that you have a required rate of return of 12 percent calculate the value of the stock. Should you purchase the stock? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts