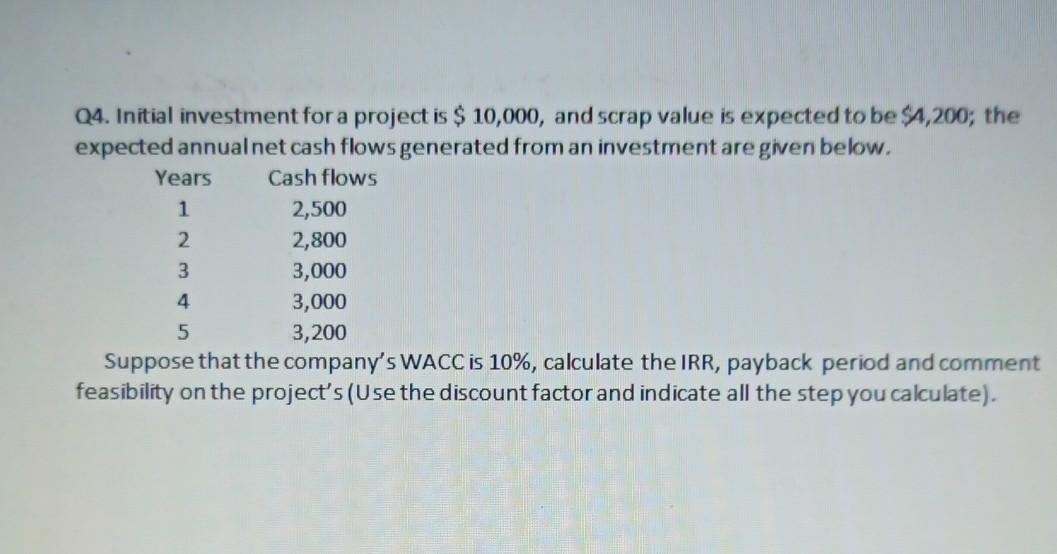

Question: Q4. Initial investment for a project is $ 10,000, and scrap value is expected to be $4,200; the expected annualnet cash flows generated from an

Q4. Initial investment for a project is $ 10,000, and scrap value is expected to be $4,200; the expected annualnet cash flows generated from an investment are given below. Years Cash flows 1 2,500 2 2,800 3 3,000 3,000 5 3,200 Suppose that the company's WACC is 10%, calculate the IRR, payback period and comment feasibility on the project's (Use the discount factor and indicate all the step you calculate). 4

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock