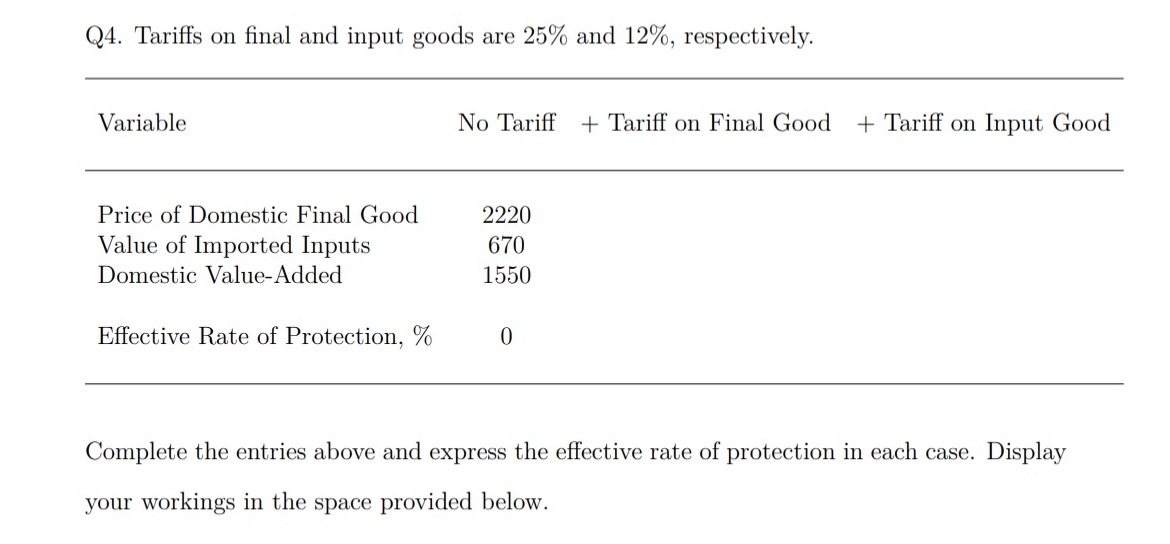

Question: Q4. Tariffs on final and input goods are 25% and 12%, respectively. Variable Price of Domestic Final Good Value of Imported Inputs Domestic Value-Added

Q4. Tariffs on final and input goods are 25% and 12%, respectively. Variable Price of Domestic Final Good Value of Imported Inputs Domestic Value-Added Effective Rate of Protection, % No Tariff + Tariff on Final Good + Tariff on Input Good 2220 670 1550 0 Complete the entries above and express the effective rate of protection in each case. Display your workings in the space provided below.

Step by Step Solution

There are 3 Steps involved in it

To calculate the effective rate of protection in each case we need to consider the tariffs on final ... View full answer

Get step-by-step solutions from verified subject matter experts