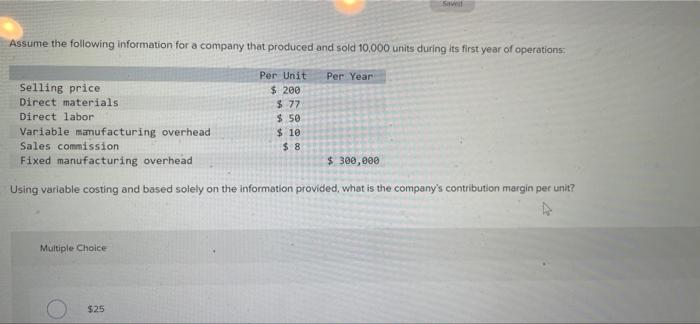

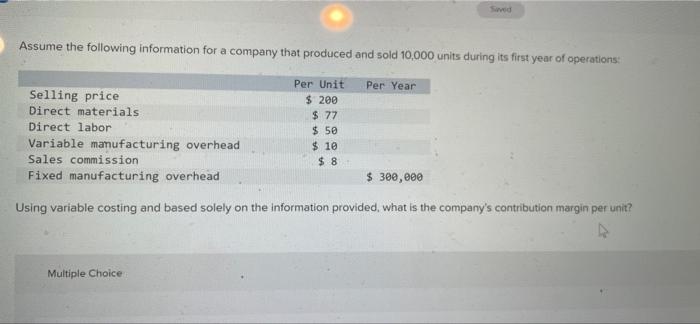

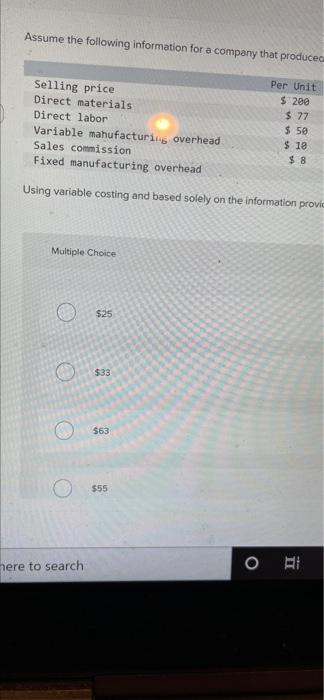

Question: Q4 - using variable costing and based solely on the information provided what is the companies contribution margin per unit? a) $25 b) $33 c)

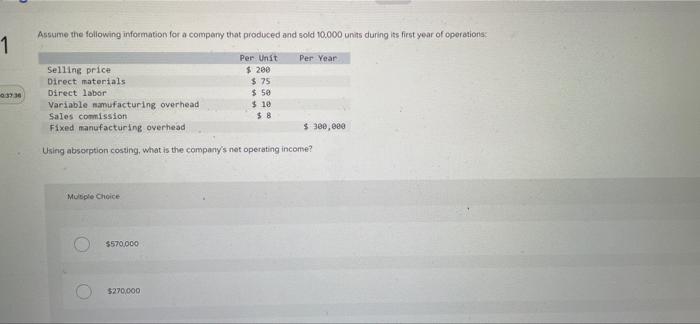

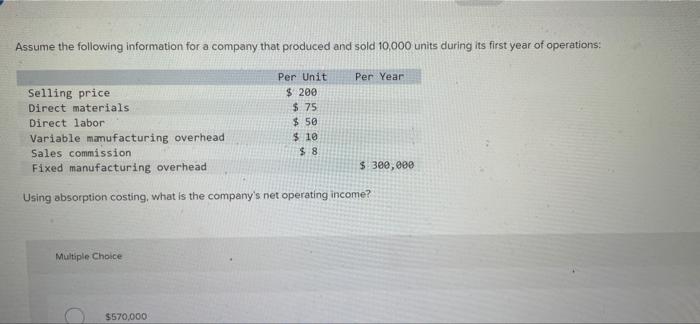

Assume the following information for a company that produced and sold 10,000 units during its first year of operations: Per Unit Per Year Selling price $ 200 Direct materials $77 Direct labor $50 Variable manufacturing overhead $ 10 Sales commission $8 Fixed manufacturing overhead $ 300,000 Using variable costing and based solely on the information provided what is the company's contribution margin per unit? Multiple Choice $25 Assume the following information for a company that produced and sold 10,000 units during its first year of operations: Per Year Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 77 $ 50 $ 10 $8 $ 300,000 Using variable costing and based solely on the information provided what is the company's contribution margin per unit? Multiple Choice Assume the following information for a company that produce Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 77 $50 $ 12 $8 Using variable costing and based solely on the information provie Multiple Choice $25 $33 o 563 $55 here to search ORI Assume the following information for a company that produced and sold 10.000 units during its first year of operations 1 Per Year Per Unit $ 200 $ 75 $ 50 $ 10 $8 Selling price Direct materials Direct labor Variable namufacturing overhead Sales commission Fixed manufacturing overhead 03736 $ 300,000 Using absorption costing, what is the company's net operating income? Multiple Choice $570.000 5270,000 Assume the following information for a company that produced and sold 10,000 units during its first year of operations: Per Year Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 75 $ 50 $ 10 $ 8 $ 300, eee Using absorption costing, what is the company's net operating income? Multiple Choice $570,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts