Question: Q40 A) B Problem 5-35 Comparing Cash Flow Streams [LO 1] You've just joined the investment banking firm of Dewey, Cheatum, and s ting of

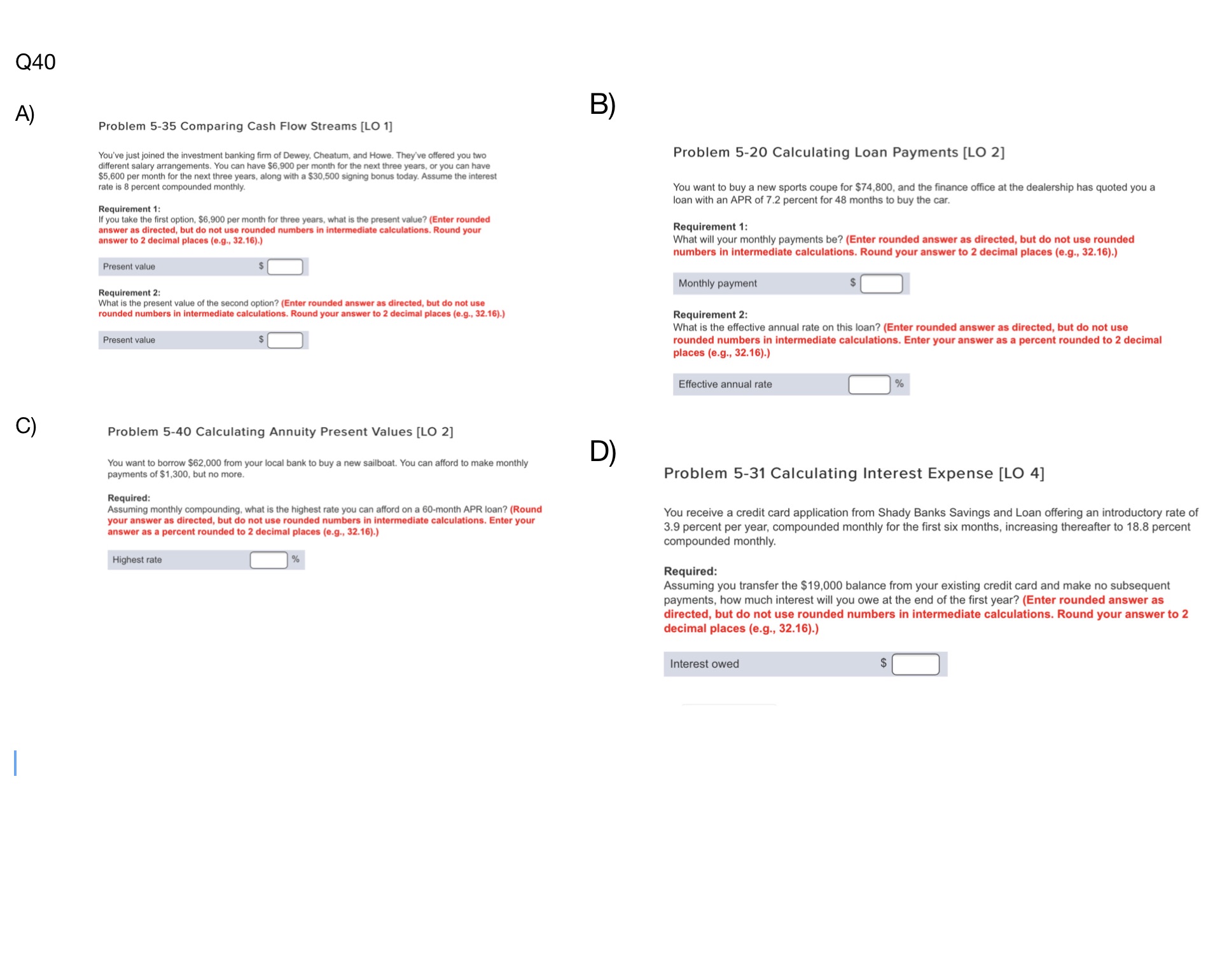

Q40 A) B Problem 5-35 Comparing Cash Flow Streams [LO 1] You've just joined the investment banking firm of Dewey, Cheatum, and s ting of Dewey. Cheatum, and Howe. They've offered you two Problem 5-20 Calculating Loan Payments [LO 2] different salary arrangements. You can have $6,900 per month for the next three years, or you can have $5,600 per month for the next three years, along with a $30,500 signing bonus today. Assume the interest rate is 8 percent compounded monthly. You want to buy a new sports coupe for $74,800, and the finance office at the dealership has quoted you a loan with an APR of 7.2 percent for 48 months to buy the car. Requirement 1: If you take the first option, $6,900 per month for three years, what is the present value? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your Requirement 1: answer to 2 decimal places (e.g., 32.16).) What will your monthly payments be? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Present value Monthly payment Requirement 2: What is the present value of the second option? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Requirement 2: What is the effective annual rate on this loan? (Enter rounded answer as directed, but do not use Present value rounded numbers in intermediate calculations. Enter your answer as a percent rounded to 2 decimal places (e.g., 32.16).) Effective annual rate C) Problem 5-40 Calculating Annuity Present Values [LO 2] D) You want to borrow $62,000 from your local bank to buy a new sailboat. You can afford to make monthly payments of $1,300, but no more. Problem 5-31 Calculating Interest Expense [LO 4] Required: Assuming monthly compounding, what is the highest rate you can afford on a 60-month APR loan? (Round your answer as directed, but do not use rounded numbers in intermediate calculations. Enter your You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of answer as a percent rounded to 2 decimal places (e.g., 32.16).) 3.9 percent per year, compounded monthly for the first six months, increasing thereafter to 18.8 percent compounded monthly. Highest rate % Required: Assuming you transfer the $19,000 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16). Interest owed