Question: Q5 (40 pts) Two water development projects have emerged as leading candidates at a location. The first project (A) consists of a series of microdams

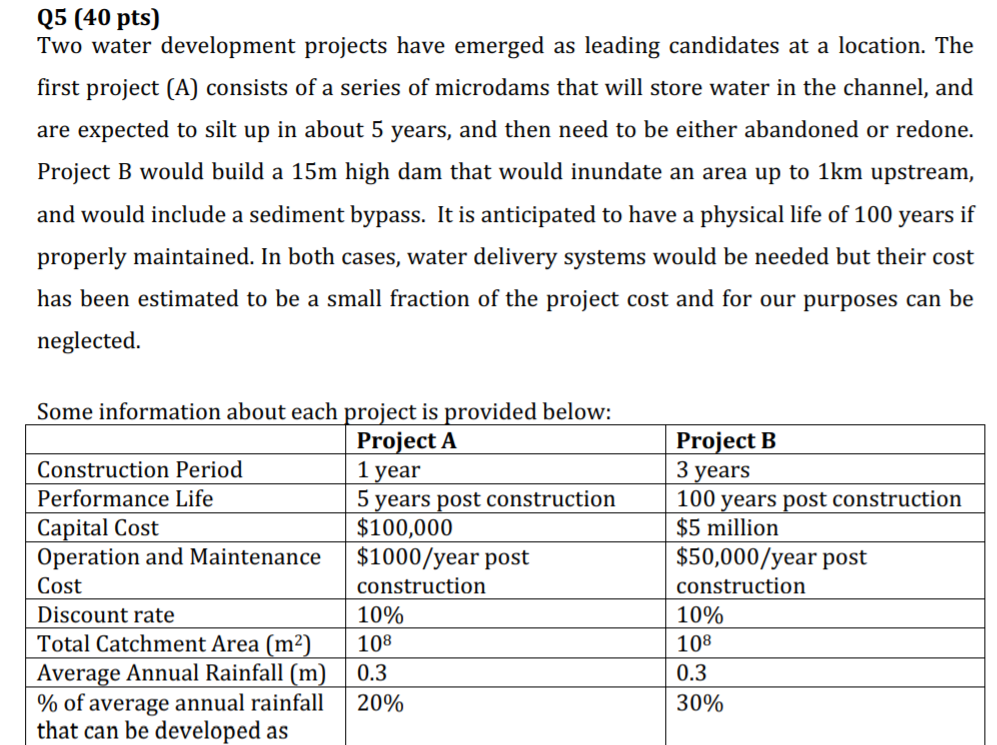

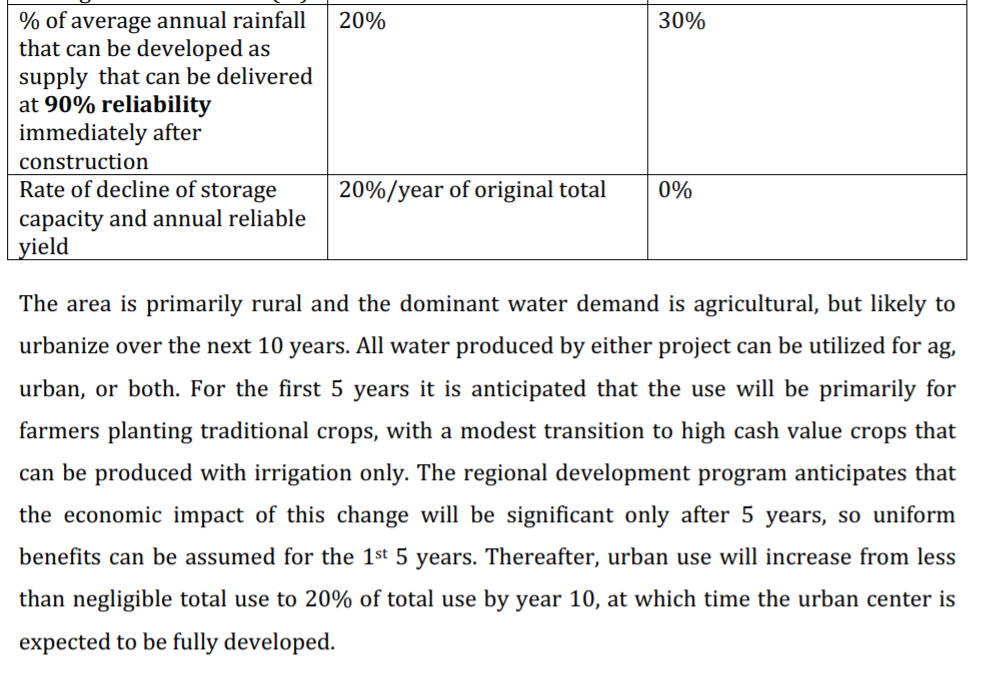

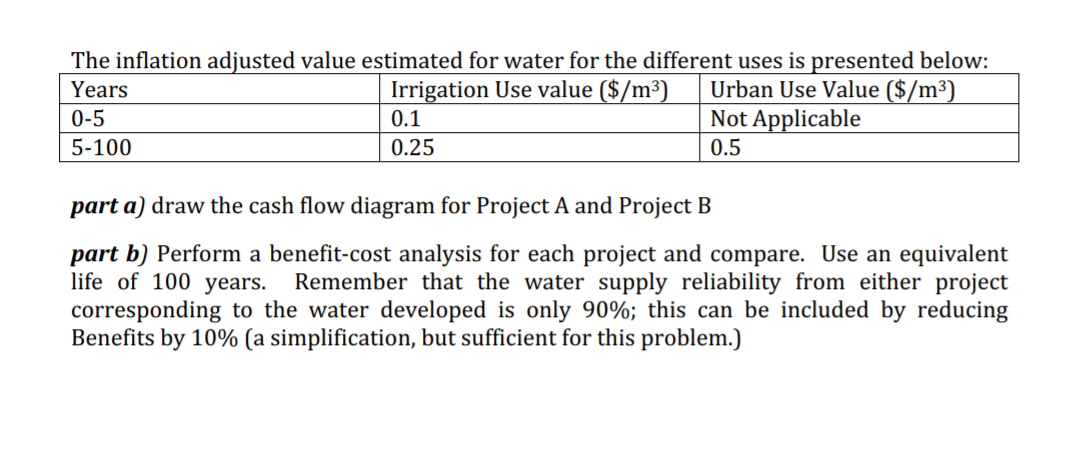

Q5 (40 pts) Two water development projects have emerged as leading candidates at a location. The first project (A) consists of a series of microdams that will store water in the channel, and are expected to silt up in about 5 years, and then need to be either abandoned or redone. Project B would build a 15m high dam that would inundate an area up to 1km upstream, and would include a sediment bypass. It is anticipated to have a physical life of 100 years if properly maintained. In both cases, water delivery systems would be needed but their cost has been estimated to be a small fraction of the project cost and for our purposes can be neglected Some information about each project is provided below: Project A Construction Period 1 year Performance Life 5 years post construction Capital Cost $100,000 Operation and Maintenance $1000/year post Cost construction Discount rate 10% Total Catchment Area (m2) | 108 Average Annual Rainfall (m) 0.3 % of average annual rainfall 20% that can be developed as Project B 3 years 100 years post construction $5 million $50,000/year post construction 10% 108 0.3 30% 30% % of average annual rainfall | 20% that can be developed as supply that can be delivered at 90% reliability immediately after construction Rate of decline of storage 20%/year of original total capacity and annual reliable yield 0% The area is primarily rural and the dominant water demand is agricultural, but likely to urbanize over the next 10 years. All water produced by either project can be utilized for ag, urban, or both. For the first 5 years it is anticipated that the use will be primarily for farmers planting traditional crops, with a modest transition to high cash value crops that can be produced with irrigation only. The regional development program anticipates that the economic impact of this change will be significant only after 5 years, so uniform benefits can be assumed for the 1st 5 years. Thereafter, urban use will increase from less than negligible total use to 20% of total use by year 10, at which time the urban center is expected to be fully developed. The inflation adjusted value estimated for water for the different uses is presented below: Years Irrigation Use value ($/m3) Urban Use Value ($/m3) 0-5 Not Applicable 5-100 0.1 0.25 0.5 part a) draw the cash flow diagram for Project A and Project B part b) Perform a benefit-cost analysis for each project and compare. Use an equivalent life of 100 years. Remember that the water supply reliability from either project corresponding to the water developed is only 90%; this can be included by reducing Benefits by 10% (a simplification, but sufficient for this problem.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts