Question: Q.5 (5 points) Consider two assets, A, B. Their spot prices at time t are denoted as StA and StB respectively. At t =0,S0A=$100 and

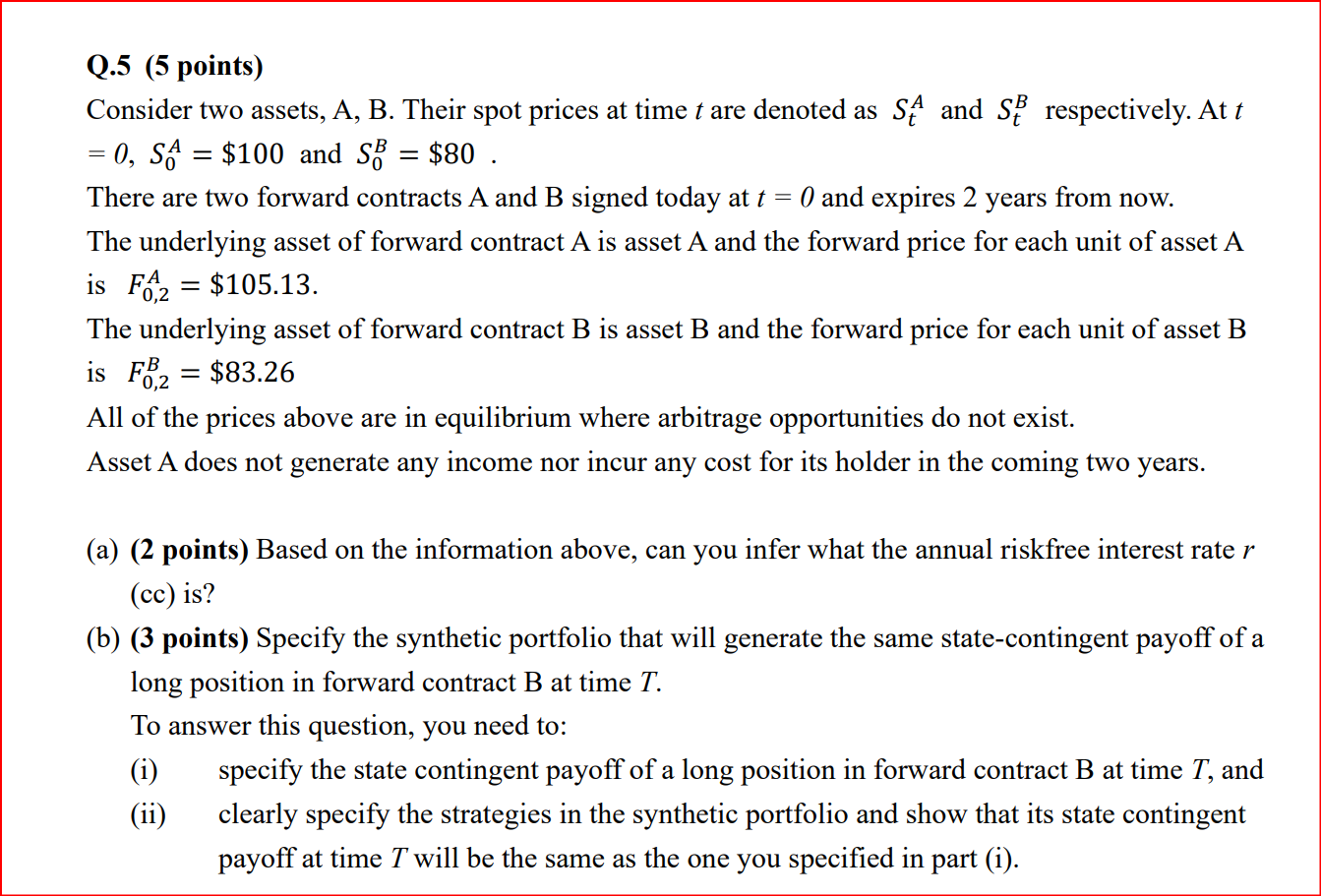

Q.5 (5 points) Consider two assets, A, B. Their spot prices at time t are denoted as StA and StB respectively. At t =0,S0A=$100 and S0B=$80. There are two forward contracts A and B signed today at t=0 and expires 2 years from now. The underlying asset of forward contract A is asset A and the forward price for each unit of asset A is F0,2A=$105.13. The underlying asset of forward contract B is asset B and the forward price for each unit of asset B is F0,2B=$83.26 All of the prices above are in equilibrium where arbitrage opportunities do not exist. Asset A does not generate any income nor incur any cost for its holder in the coming two years. (a) (2 points) Based on the information above, can you infer what the annual riskfree interest rate r (cc) is? (b) (3 points) Specify the synthetic portfolio that will generate the same state-contingent payoff of a long position in forward contract B at time T. To answer this question, you need to: (i) specify the state contingent payoff of a long position in forward contract B at time T, and (ii) clearly specify the strategies in the synthetic portfolio and show that its state contingent payoff at time T will be the same as the one you specified in part (i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts