Question: Q5 (a) You are given two n-year 1,000 par value bonds. Bond X has 14% semi-annual coupons and a price of RM 1,407.70 to yield

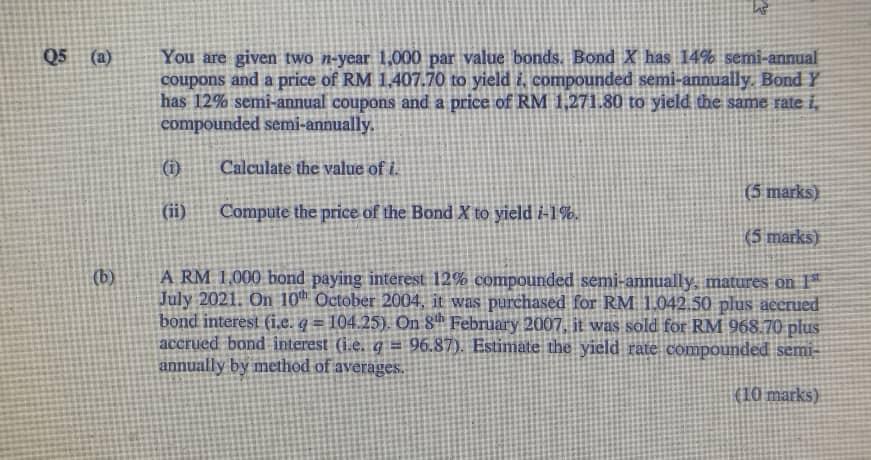

Q5 (a) You are given two n-year 1,000 par value bonds. Bond X has 14% semi-annual coupons and a price of RM 1,407.70 to yield 3, compounded semi-annually. Bond Y has 12% semi-annual coupons and a price of RM 1,271.80 to yield the same rate i, compounded semi-annually. (1) Calculate the value of i. (5 marks) (ii) Compute the price of the Bond X to yield 1-1%. (5 marks) (b) A RM 1,000 bond paying interest 12% compounded semi-annually, matures on I July 2021. On 10th October 2004, it was purchased for RM 1.042.50 plus accrued bond interest (i.e. q = 104.25). On 8th February 2007. it was sold for RM 968.70 plus accrued bond interest (e. g = 96.87). Estimate the yield rate compounded semi- annually by method of averages. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts