Question: Q5. This question uses the interest-rate tree in the spreadsheet ClassEx-LN04. Risk-neutral probabilities are given by q = 0.5. a) What is the price, per

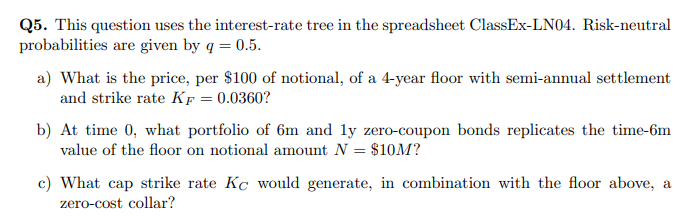

Q5. This question uses the interest-rate tree in the spreadsheet ClassEx-LN04. Risk-neutral probabilities are given by q = 0.5.

a) What is the price, per $100 of notional, of a 4-year floor with semi-annual settlement and strike rate KF = 0.0360?

b) At time 0, what portfolio of 6m and 1y zero-coupon bonds replicates the time-6m value of the floor on notional amount N = $10M?

c) What cap strike rate KC would generate, in combination with the floor above, a zero-cost collar?

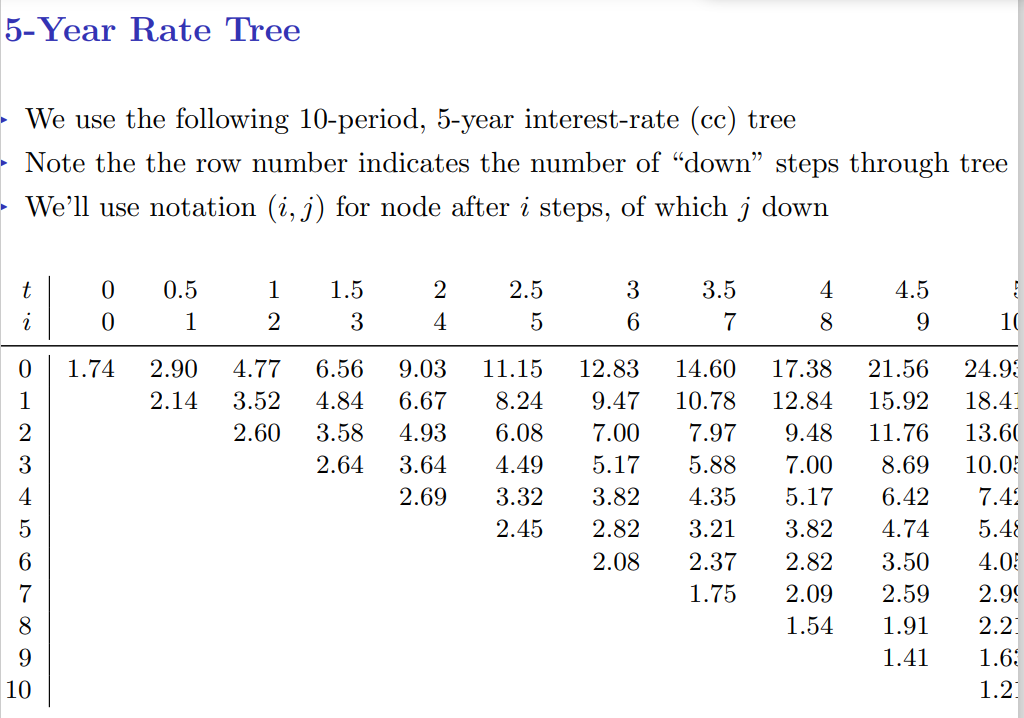

Q5. This question uses the interest-rate tree in the spreadsheet ClassEx-LN04. Risk-neutral probabilities are given by q = 0.5. a) What is the price, per $100 of notional, of a 4-year floor with semi-annual settlement and strike rate Kf = 0.0360? b) At time 0, what portfolio of 6m and ly zero-coupon bonds replicates the time-6m value of the floor on notional amount N = $10M? c) What cap strike rate Kc would generate, in combination with the floor above, a zero-cost collar? 5-Year Rate Tree We use the following 10-period, 5-year interest-rate (cc) tree Note the the row number indicates the number of down steps through tree We'll use notation (i,j) for node after i steps, of which j down 3.5 4 t i 0 0 0.5 1 1 2 1.5 3 2 4 2.5 5 3 6 4.5 9 7 8 10 0 1.74 2.90 2.14 4.77 3.52 2.60 6.56 4.84 3.58 2.64 9.03 6.67 4.93 3.64 2.69 11.15 8.24 6.08 4.49 3.32 2.45 3 12.83 9.47 7.00 5.17 3.82 2.82 2.08 500 voor A CON 14.60 10.78 7.97 5.88 4.35 3.21 2.37 1.75 17.38 12.84 9.48 7.00 5.17 3.82 2.82 2.09 1.54 21.56 15.92 11.76 8.69 6.42 4.74 3.50 2.59 1.91 1.41 24.93 18.4 13.60 10.0 7.42 5.48 4.0 2.99 2.2 1.6: 1.2 6 7 8 9 10 Q5. This question uses the interest-rate tree in the spreadsheet ClassEx-LN04. Risk-neutral probabilities are given by q = 0.5. a) What is the price, per $100 of notional, of a 4-year floor with semi-annual settlement and strike rate Kf = 0.0360? b) At time 0, what portfolio of 6m and ly zero-coupon bonds replicates the time-6m value of the floor on notional amount N = $10M? c) What cap strike rate Kc would generate, in combination with the floor above, a zero-cost collar? 5-Year Rate Tree We use the following 10-period, 5-year interest-rate (cc) tree Note the the row number indicates the number of down steps through tree We'll use notation (i,j) for node after i steps, of which j down 3.5 4 t i 0 0 0.5 1 1 2 1.5 3 2 4 2.5 5 3 6 4.5 9 7 8 10 0 1.74 2.90 2.14 4.77 3.52 2.60 6.56 4.84 3.58 2.64 9.03 6.67 4.93 3.64 2.69 11.15 8.24 6.08 4.49 3.32 2.45 3 12.83 9.47 7.00 5.17 3.82 2.82 2.08 500 voor A CON 14.60 10.78 7.97 5.88 4.35 3.21 2.37 1.75 17.38 12.84 9.48 7.00 5.17 3.82 2.82 2.09 1.54 21.56 15.92 11.76 8.69 6.42 4.74 3.50 2.59 1.91 1.41 24.93 18.4 13.60 10.0 7.42 5.48 4.0 2.99 2.2 1.6: 1.2 6 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts