Question: Q5. Treasury bills are quoted using the yield on a discount basis or on a money-market basis. 1. The yield on a discount basis denoted

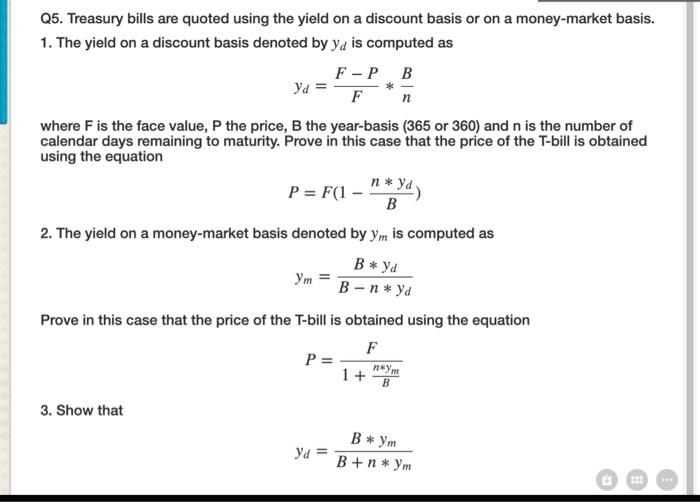

Q5. Treasury bills are quoted using the yield on a discount basis or on a money-market basis. 1. The yield on a discount basis denoted by ya is computed as F-PB yd = F n where F is the face value, P the price, B the year-basis (365 or 360) and n is the number of calendar days remaining to maturity. Prove in this case that the price of the T-bill is obtained using the equation * - P = F(1 n* ya B 2. The yield on a money-market basis denoted by Ym is computed as * ya B-n* yd Prove in this case that the price of the T-bill is obtained using the equation F P = 1+ ym nym B 3. Show that yd = + B+n* Ym

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock