Question: Q5. What is Interest Rate Parity Relation, please write down the formula, explain it in details and prove it mathematically. Q6. Please explain what factors

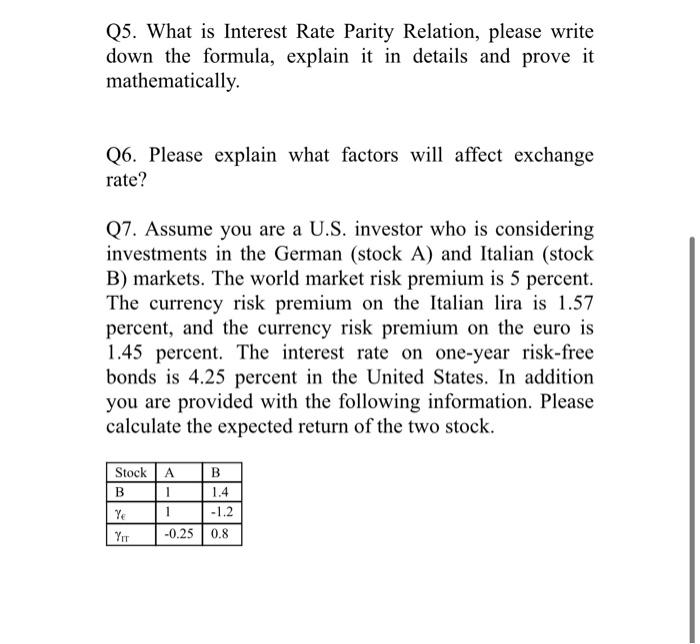

Q5. What is Interest Rate Parity Relation, please write down the formula, explain it in details and prove it mathematically. Q6. Please explain what factors will affect exchange rate? Q7. Assume you are a U.S. investor who is considering investments in the German (stock A) and Italian (stock B) markets. The world market risk premium is 5 percent. The currency risk premium on the Italian lira is 1.57 percent, and the currency risk premium on the euro is 1.45 percent. The interest rate on one-year risk-free bonds is 4.25 percent in the United States. In addition you are provided with the following information. Please calculate the expected return of the two stock. Stock A B B 1 1.4 Ye 1 -1.2 YIT -0.25 0.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts