Question: Q.5a. Define before-tax analysis? Q.5b. Machine X has been used for 15 years and currently has a book value of $29,750. A decision must be

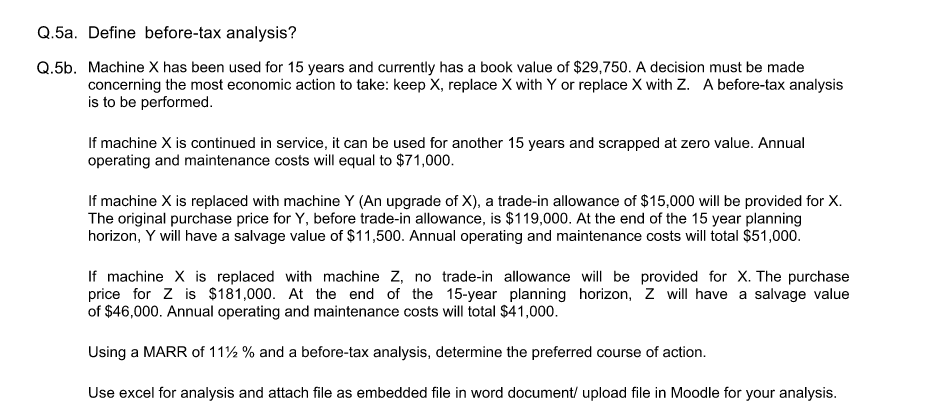

Q.5a. Define before-tax analysis? Q.5b. Machine X has been used for 15 years and currently has a book value of $29,750. A decision must be made concerning the most economic action to take: keep X, replace X with Y or replace X with Z. A before-tax analysis is to be performed. If machine X is continued in service, it can be used for another 15 years and scrapped at zero value. Annual operating and maintenance costs will equal to $71,000. If machine X is replaced with machine Y (An upgrade of X ), a trade-in allowance of $15,000 will be provided for X. The original purchase price for Y, before trade-in allowance, is $119,000. At the end of the 15 year planning horizon, Y will have a salvage value of $11,500. Annual operating and maintenance costs will total $51,000. If machine X is replaced with machine Z, no trade-in allowance will be provided for X. The purchase price for Z is $181,000. At the end of the 15 -year planning horizon, Z will have a salvage value of $46,000. Annual operating and maintenance costs will total $41,000. Using a MARR of 11121% and a before-tax analysis, determine the preferred course of action. Use excel for analysis and attach file as embedded file in word document/ upload file in Moodle for your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts