Question: Q5s correct answer is 0.45 and Q6s correct answer is 4.17. Don't know how to calculate them. Question 5 0/2 points A founder finds it

Q5s correct answer is 0.45 and Q6s correct answer is 4.17. Don't know how to calculate them.

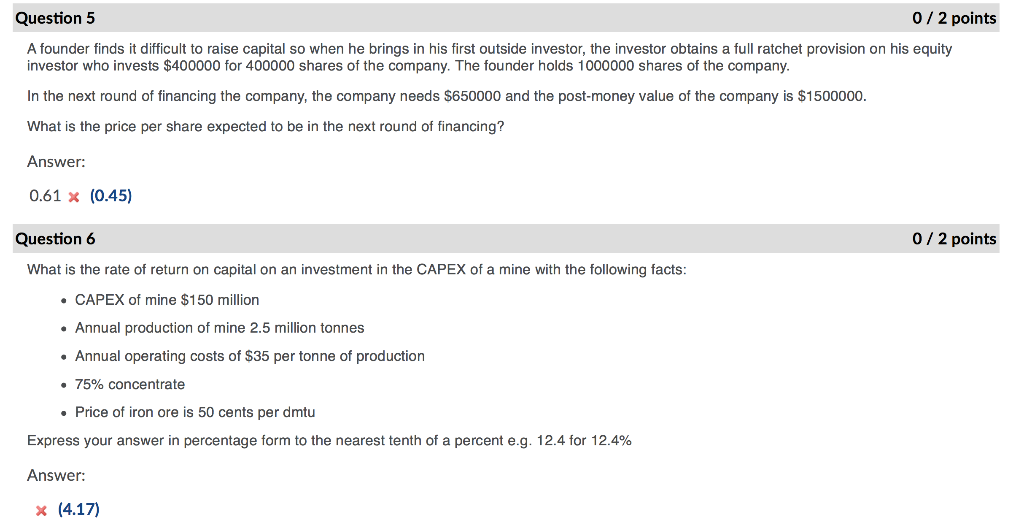

Question 5 0/2 points A founder finds it difficult to raise capital so when he brings in his first outside investor, the investor obtains a full ratchet provision on his equity investor who invests $400000 for 400000 shares of the company. The founder holds 1000000 shares of the company. In the next round of financing the company, the company needs $650000 and the post-money value of the company is $1500000. What is the price per share expected to be in the next round of financing? Answer: 0.61 x (0.45) Question 6 0/2 points What is the rate of return on capital on an investment in the CAPEX of a mine with the following facts: CAPEX of mine $150 million Annual production of mine 2.5 million tonnes Annual operating costs of $35 per tonne of production 75% concentrate Price of iron ore is 50 cents per dmtu Express your answer in percentage form to the nearest tenth of a percent e.g. 12.4 for 12.4% Answer: * (4.17) Question 5 0/2 points A founder finds it difficult to raise capital so when he brings in his first outside investor, the investor obtains a full ratchet provision on his equity investor who invests $400000 for 400000 shares of the company. The founder holds 1000000 shares of the company. In the next round of financing the company, the company needs $650000 and the post-money value of the company is $1500000. What is the price per share expected to be in the next round of financing? Answer: 0.61 x (0.45) Question 6 0/2 points What is the rate of return on capital on an investment in the CAPEX of a mine with the following facts: CAPEX of mine $150 million Annual production of mine 2.5 million tonnes Annual operating costs of $35 per tonne of production 75% concentrate Price of iron ore is 50 cents per dmtu Express your answer in percentage form to the nearest tenth of a percent e.g. 12.4 for 12.4% Answer: * (4.17)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts