Question: Q6 Watertown Paper Corporation is considering adding another machine for the manufacture of corrugated cardboard. The machine would cost $1,300,000. It would have an estimated

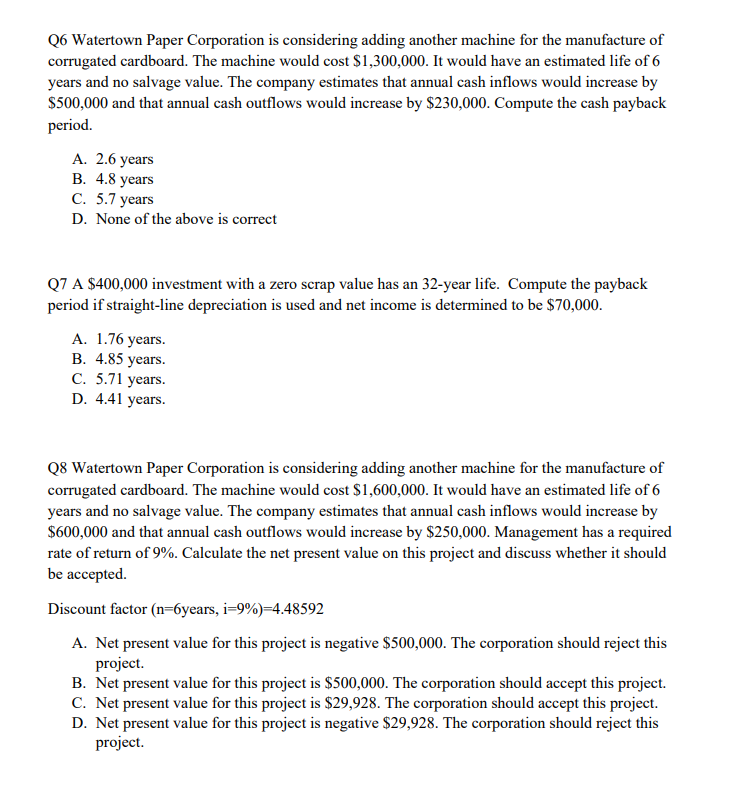

Q6 Watertown Paper Corporation is considering adding another machine for the manufacture of corrugated cardboard. The machine would cost $1,300,000. It would have an estimated life of 6 years and no salvage value. The company estimates that annual cash inflows would increase by S500,000 and that annual cash outflows would increase by $230,000. Compute the cash payback period . 2.6 years . 4.8 years . 5.7 years D. None of the above is correct Q7 A $400,000 investment with a zero scrap value has an 32-year life. Compute the payback period if straight-line depreciation is used and net income is determined to be $70,000. A. 1.76 years B. 4.85 years. C. 5.71 years D. 4.41 years Q8 Watertown Paper Corporation is considering adding another machine for the manufacture of corrugated cardboard. The machine would cost $1,600,000. It would have an estimated life of 6 years and no salvage value. The company estimates that annual cash inflows would increase by $600,000 and that annual cash outflows would increase by $250,000. Management has a required rate of return of 9%. Calculate the net present value on this project and discuss whether it should be accepted Discount factor (n=6years, i=9%)=4.48592 A. Net present value for this project is negative $500,000. The corporation should reject this project B. Net present value for this project is $500,000. The corporation should accept this project C. Net present value for this project is $29,928. The corporation should accept this project D. Net present value for this project is negative $29,928. The corporation should reject this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts