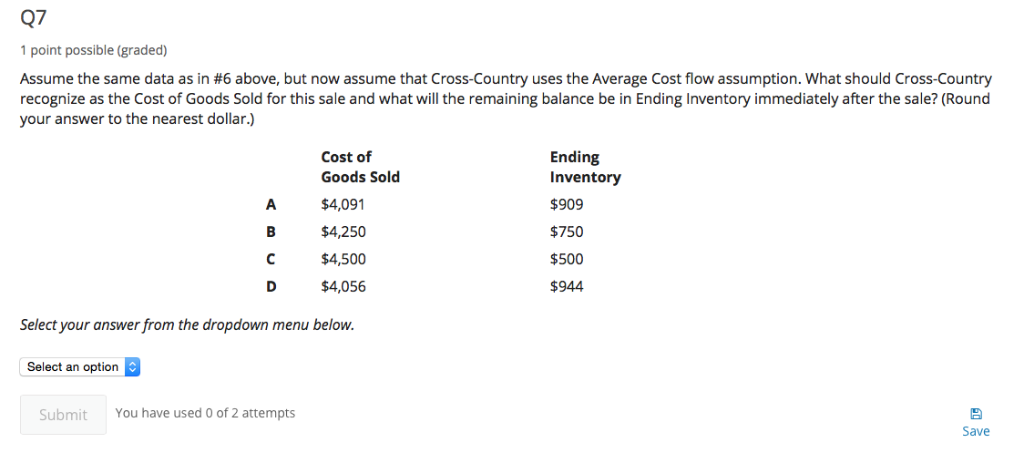

Question: Q7 1 point possible (graded) Assume the same data as in #6 above, but now assume that Cross-Country uses the Average Cost flow assumption. What

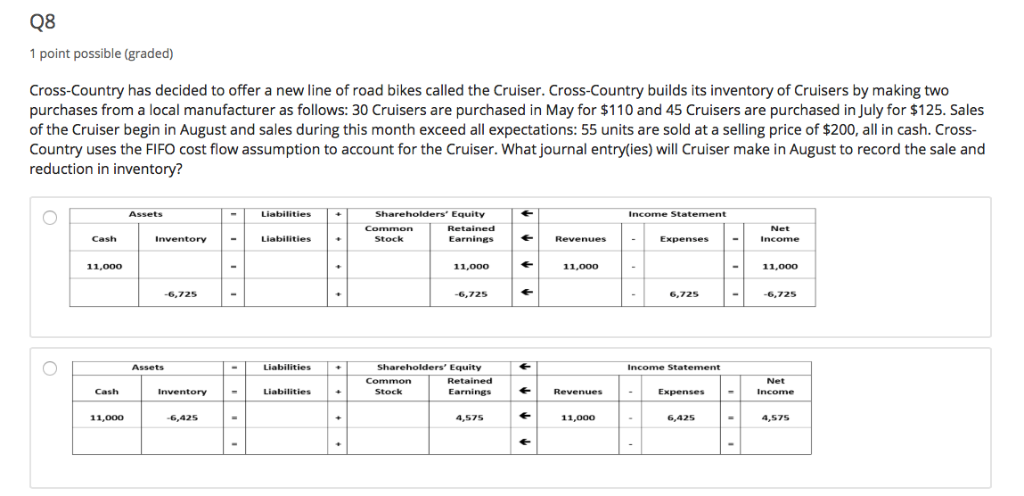

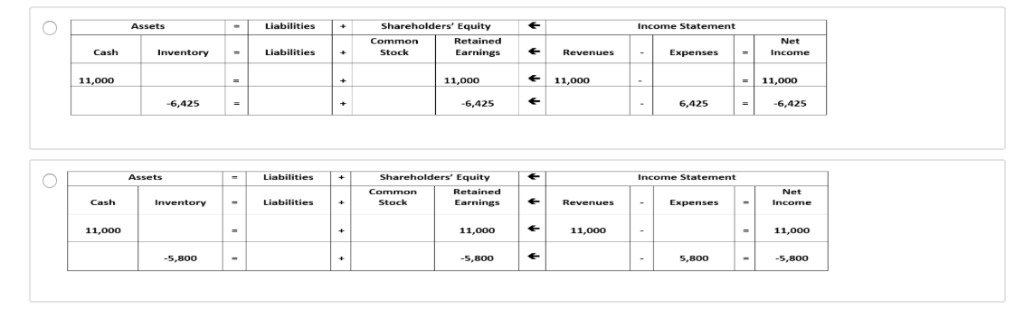

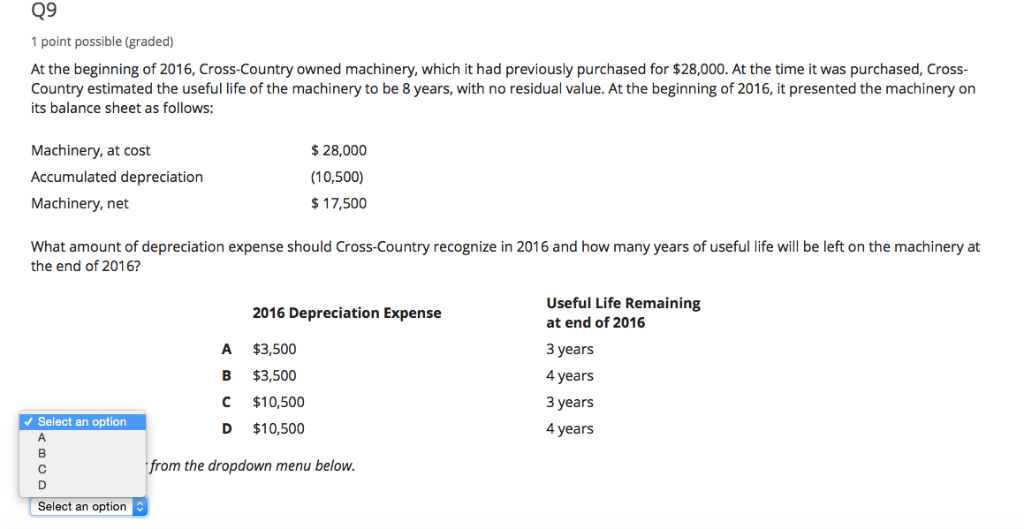

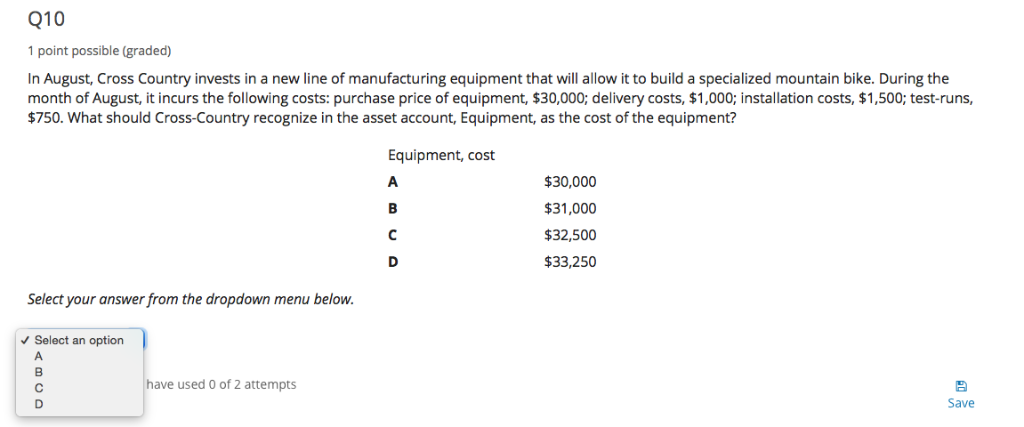

Q7 1 point possible (graded) Assume the same data as in #6 above, but now assume that Cross-Country uses the Average Cost flow assumption. What should Cross-Country recognize as the Cost of Goods Sold for this sale and what will the remaining balance be in Ending Inventory immediately after the sale? (Round your answer to the nearest dollar.) Cost of Ending Inventory Goods Sold 606$ $750 A $4,091 B $4,250 $4,500 $500 $4,056 $944 Select your answer from the dropdown menu below. Select an option You have used 0 of 2 attempts Submit Save Q8 point possible (graded) Cross-Country has decided to offer a new line of road bikes called the Cruiser. Cross-Country builds its inventory of Cruisers by making two purchases from a local manufacturer as follows: 30 Cruisers are purchased in May for $110 and 45 Cruisers are purchased in July for $125. Sales of the Cruiser begin in August and sales during this month exceed all expectations: 55 units are sold at a selling price of $200, all in cash. Cross- Country uses the FIFO cost flow assumption to account for the Cruiser. What journal entry(ies) will Cruiser make in August to record the sale and reduction in inventory? Shareholders Equity Assets Liabilities Income Statement Sernings Liabilities Stock Cash Inventory Revenues Expenses In 11,000 11,000 11.000 11,000 6.725 -6,725 6 725 -6,725 - Assets Liabilities Shareholders' Equity Income Statement Retained Common Net Cash Stock Earnings Inventory Liabilities Revenues Expenses Income 4,575 11,000 11.000 6,425 6,425 4,575 Shareholders' Equity Liabilities Assets Income Statement Retained Earnings Common Net Cash Stock Inventory Liabilities Revenues xpenses Income + 11,000 11.000 11,000 11,000 -6.425 -6,425 6.425 -6.425 - + = Shareholders' Equity Assets Liabilities Income Statement Ce on Liabilities Cash Inventory stock Farnings Revenues Expenses 11,000 11.000 11.000 11,000 -5.800 -5,800 s,800 -s,800 4 Q9 point possible (graded) At the beginning of 2016, Cross-Country owned machinery, which it had previously purchased for $28,000. At the time it was purchased, Cross- Country estimated the useful life of the machinery to be 8 years, with no residual value. At the beginning of 2016, it presented the machinery on its balance sheet as follows: Machinery, at cost $28,000 (10,500) Accumulated depreciation Machinery, net $17,500 What amount of depreciation expense should Cross-Country recognize in 2016 and how many years of useful life will be left on the machinery at the end of 2016? Useful Life Remaining 2016 Depreciation Expense at end of 2016 A $3,500 3 years B $3,500 4 years years $10,500 Select an option $10,500 4 years A B from the dropdown menu below. C D Select an option Q10 1 point possible (graded) In August, Cross Country invests in a new line of manufacturing equipment that will allow it to build a specialized mountain bike. During the month of August, it incurs the following costs: purchase price of equipment, $30,000; delivery costs, $1,000; installation costs, $1,500; test-runs $750. What should Cross-Country recognize in the asset account, Equipment, as the cost of the equipment? Equipment, cost $30,000 A B $31,000 C $32,500 D $33,250 Select your answer from the dropdown menu below. Select an option A have used 0 of 2 attempts C Save D Q7 1 point possible (graded) Assume the same data as in #6 above, but now assume that Cross-Country uses the Average Cost flow assumption. What should Cross-Country recognize as the Cost of Goods Sold for this sale and what will the remaining balance be in Ending Inventory immediately after the sale? (Round your answer to the nearest dollar.) Cost of Ending Inventory Goods Sold 606$ $750 A $4,091 B $4,250 $4,500 $500 $4,056 $944 Select your answer from the dropdown menu below. Select an option You have used 0 of 2 attempts Submit Save Q8 point possible (graded) Cross-Country has decided to offer a new line of road bikes called the Cruiser. Cross-Country builds its inventory of Cruisers by making two purchases from a local manufacturer as follows: 30 Cruisers are purchased in May for $110 and 45 Cruisers are purchased in July for $125. Sales of the Cruiser begin in August and sales during this month exceed all expectations: 55 units are sold at a selling price of $200, all in cash. Cross- Country uses the FIFO cost flow assumption to account for the Cruiser. What journal entry(ies) will Cruiser make in August to record the sale and reduction in inventory? Shareholders Equity Assets Liabilities Income Statement Sernings Liabilities Stock Cash Inventory Revenues Expenses In 11,000 11,000 11.000 11,000 6.725 -6,725 6 725 -6,725 - Assets Liabilities Shareholders' Equity Income Statement Retained Common Net Cash Stock Earnings Inventory Liabilities Revenues Expenses Income 4,575 11,000 11.000 6,425 6,425 4,575 Shareholders' Equity Liabilities Assets Income Statement Retained Earnings Common Net Cash Stock Inventory Liabilities Revenues xpenses Income + 11,000 11.000 11,000 11,000 -6.425 -6,425 6.425 -6.425 - + = Shareholders' Equity Assets Liabilities Income Statement Ce on Liabilities Cash Inventory stock Farnings Revenues Expenses 11,000 11.000 11.000 11,000 -5.800 -5,800 s,800 -s,800 4 Q9 point possible (graded) At the beginning of 2016, Cross-Country owned machinery, which it had previously purchased for $28,000. At the time it was purchased, Cross- Country estimated the useful life of the machinery to be 8 years, with no residual value. At the beginning of 2016, it presented the machinery on its balance sheet as follows: Machinery, at cost $28,000 (10,500) Accumulated depreciation Machinery, net $17,500 What amount of depreciation expense should Cross-Country recognize in 2016 and how many years of useful life will be left on the machinery at the end of 2016? Useful Life Remaining 2016 Depreciation Expense at end of 2016 A $3,500 3 years B $3,500 4 years years $10,500 Select an option $10,500 4 years A B from the dropdown menu below. C D Select an option Q10 1 point possible (graded) In August, Cross Country invests in a new line of manufacturing equipment that will allow it to build a specialized mountain bike. During the month of August, it incurs the following costs: purchase price of equipment, $30,000; delivery costs, $1,000; installation costs, $1,500; test-runs $750. What should Cross-Country recognize in the asset account, Equipment, as the cost of the equipment? Equipment, cost $30,000 A B $31,000 C $32,500 D $33,250 Select your answer from the dropdown menu below. Select an option A have used 0 of 2 attempts C Save D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts