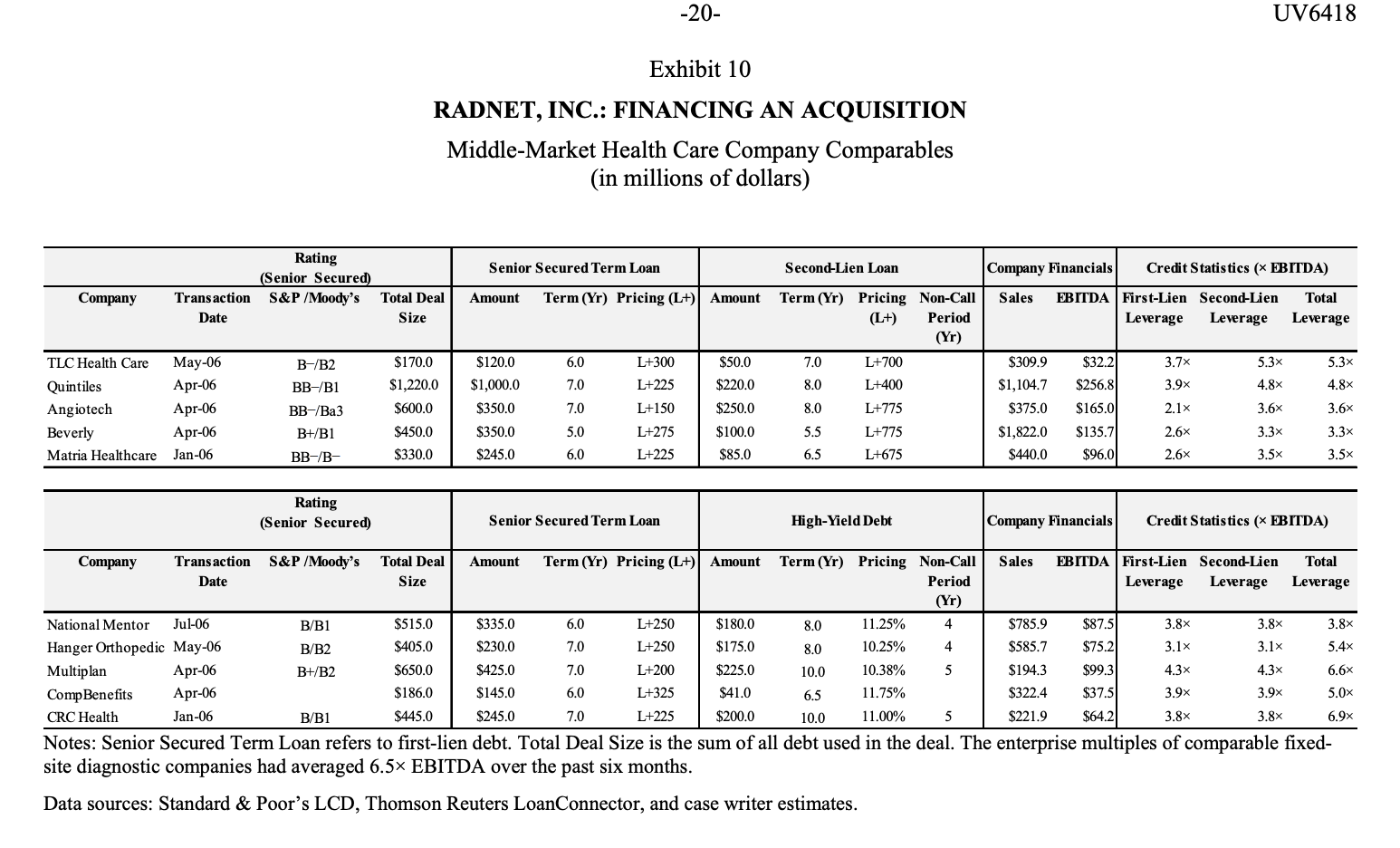

Question: Q7: Based on information from Exhibit 10, do you think the financing option provided by GE (first-lien debt + second-lien debt) is a reasonable one?

Q7: Based on information from Exhibit 10, do you think the financing option provided by GE (first-lien debt + second-lien debt) is a reasonable one? Why?

RADNET, INC.: FINANCING AN ACQUISITION Middle-Market Health Care Company Comparables (in millions of dollars) Notes: Senior Secured Term Loan refers to first-lien debt. Total Deal Size is the sum of all debt used in the deal. The enterprise multiples of comparable fixedsite diagnostic companies had averaged 6.5 EBITDA over the past six months. Data sources: Standard \& Poor's LCD, Thomson Reuters LoanConnector, and case writer estimates. RADNET, INC.: FINANCING AN ACQUISITION Middle-Market Health Care Company Comparables (in millions of dollars) Notes: Senior Secured Term Loan refers to first-lien debt. Total Deal Size is the sum of all debt used in the deal. The enterprise multiples of comparable fixedsite diagnostic companies had averaged 6.5 EBITDA over the past six months. Data sources: Standard \& Poor's LCD, Thomson Reuters LoanConnector, and case writer estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts