Question: Q7. Peking Duct Tape Company has outstanding a $1,000-face-value bond with a 14 percent coupon rate and 3 years remaining until final maturity. Interest payments

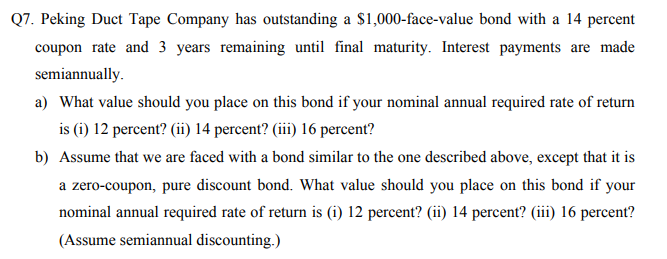

Q7. Peking Duct Tape Company has outstanding a $1,000-face-value bond with a 14 percent coupon rate and 3 years remaining until final maturity. Interest payments are made semiannually. a) What value should you place on this bond if your nominal annual required rate of return is (1) 12 percent? (ii) 14 percent? (iii) 16 percent? b) Assume that we are faced with a bond similar to the one described above, except that it is a zero-coupon, pure discount bond. What value should you place on this bond if your nominal annual required rate of return is (i) 12 percent? (ii) 14 percent? (iii) 16 percent? (Assume semiannual discounting.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts