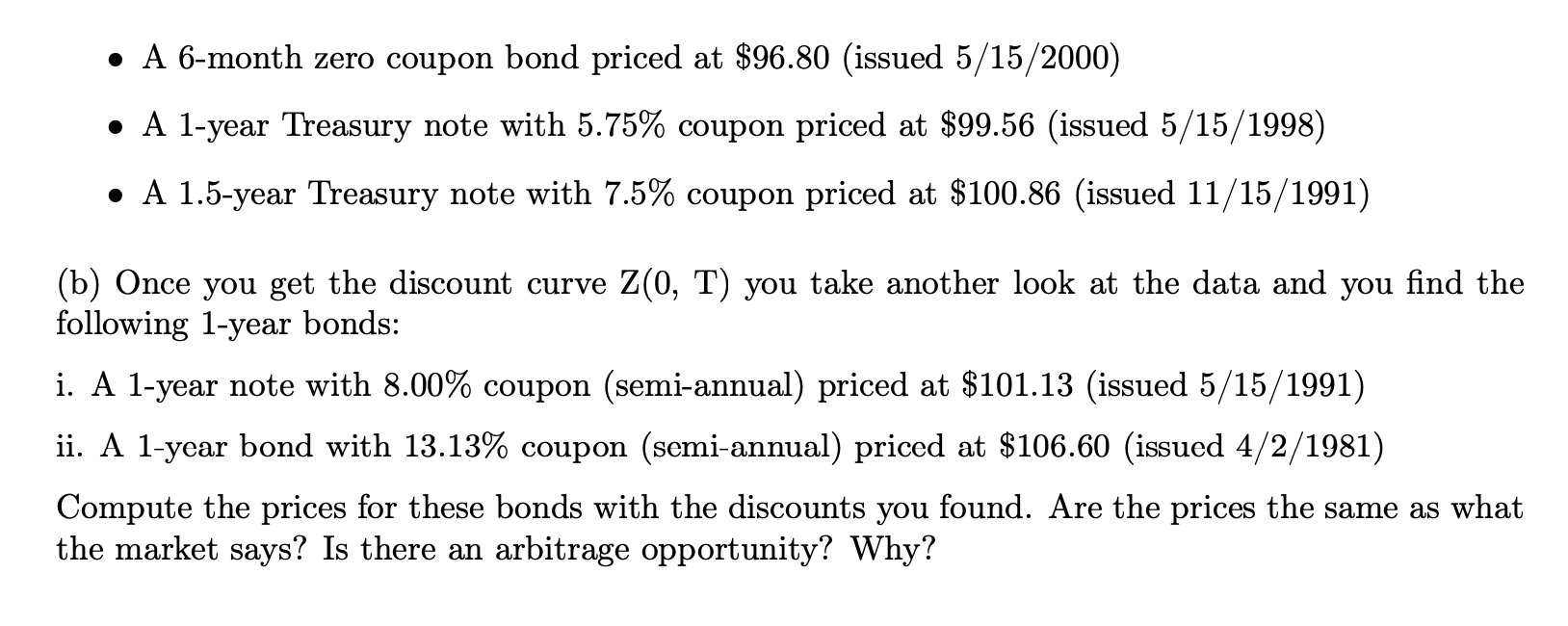

Question: Q7. Today is May 15, 2000. (a) Compute (bootstrap) the discount curve Z(0,T) for T =6 month, 1 year, and 1.5 years from the following

Q7. Today is May 15, 2000. (a) Compute (bootstrap) the discount curve Z(0,T) for T =6 month, 1 year, and 1.5 years from the following data: A 6-month zero coupon bond priced at $96.80 (issued 5/15/2000) A 1-year Treasury note with 5.75% coupon priced at $99.56 (issued 5/15/1998) A 1.5-year Treasury note with 7.5% coupon priced at $100.86 (issued 11/15/1991) (b) Once you get the discount curve Z(0, T) you take another look at the data and you find the following 1-year bonds: i. A 1-year note with 8.00% coupon (semi-annual) priced at $101.13 (issued 5/15/1991) ii. A 1-year bond with 13.13% coupon (semi-annual) priced at $106.60 (issued 4/2/1981) Compute the prices for these bonds with the discounts you found. Are the prices the same as what the market says? Is there an arbitrage opportunity? Why? Q7. Today is May 15, 2000. (a) Compute (bootstrap) the discount curve Z(0,T) for T =6 month, 1 year, and 1.5 years from the following data: A 6-month zero coupon bond priced at $96.80 (issued 5/15/2000) A 1-year Treasury note with 5.75% coupon priced at $99.56 (issued 5/15/1998) A 1.5-year Treasury note with 7.5% coupon priced at $100.86 (issued 11/15/1991) (b) Once you get the discount curve Z(0, T) you take another look at the data and you find the following 1-year bonds: i. A 1-year note with 8.00% coupon (semi-annual) priced at $101.13 (issued 5/15/1991) ii. A 1-year bond with 13.13% coupon (semi-annual) priced at $106.60 (issued 4/2/1981) Compute the prices for these bonds with the discounts you found. Are the prices the same as what the market says? Is there an arbitrage opportunity? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts