Question: Q7. When would the direct method and the step-down methd of service depoenent eest allocation nesult in identical allocations heieg made so the operating deparmanst

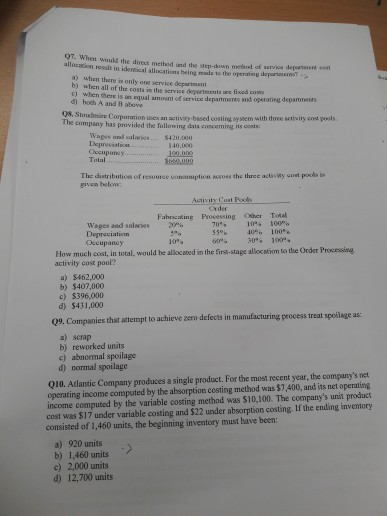

Q7. When would the direct method and the step-down methd of service depoenent eest allocation nesult in identical allocations heieg made so the operating deparmanst a) when there is only one service depariment b) when all of the costs in the seevice depertmenta es tisad cots c) when there i d both A and B abover s equal amount of service departments and operating departments- Q8. Stoudnire Corporation uses an activity-based costing system with three activity coet pools The company has provided the following data conceming its costst Wages and salaries Depreciation Oecupancy Tulal $420,000 140,000 Jo0,000 S660,000 The distribution of resource contaetion oes the three stivty cot pools is given below: Activity Cost Pools Crder Total Fahricating Pre 20% Other 0eessing Wages and salacies Depreciation Occupanoy 10% 100%% 40% 00e s5e% 100 30% 10% How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool? a) $462,000 b) $407,000 c) $396,000 d) $431,000 09, Companies that attempt to achieve zero defects in manutacturing process treat spoilage as a) scrap b) reworked units c) abnormal spoilage d) normal spoilage Q10. Atlantic Company produces a single product. For the most recent year, the company's net operating income computed by the absorption costing method was $7,400, and its net operating income computed by the variable costing method was $10,100. The company's unit product. cost was $17 under variable costing and $22 under absorption costing. If the ending inventory consisted of 1,460 units, the beginning inventory must have been: a) 920 units b) 1,460 units c) 2,000 units d) 12,700 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts