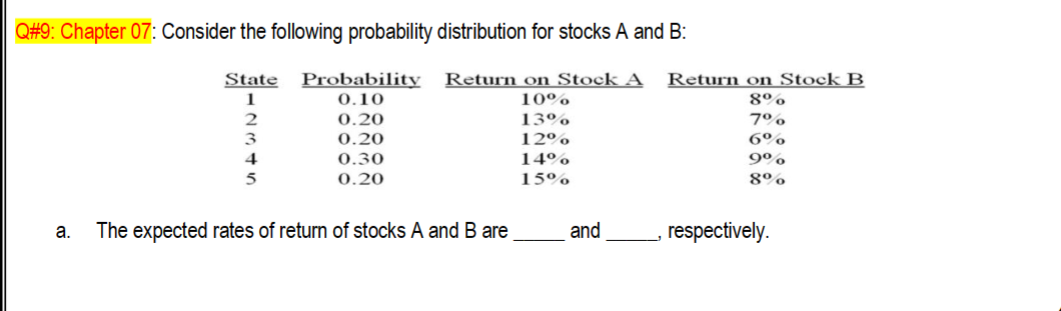

Question: Q#9: Chapter 07: Consider the following probability distribution for stocks A and B: a. The expected rates of return of stocks A and B are

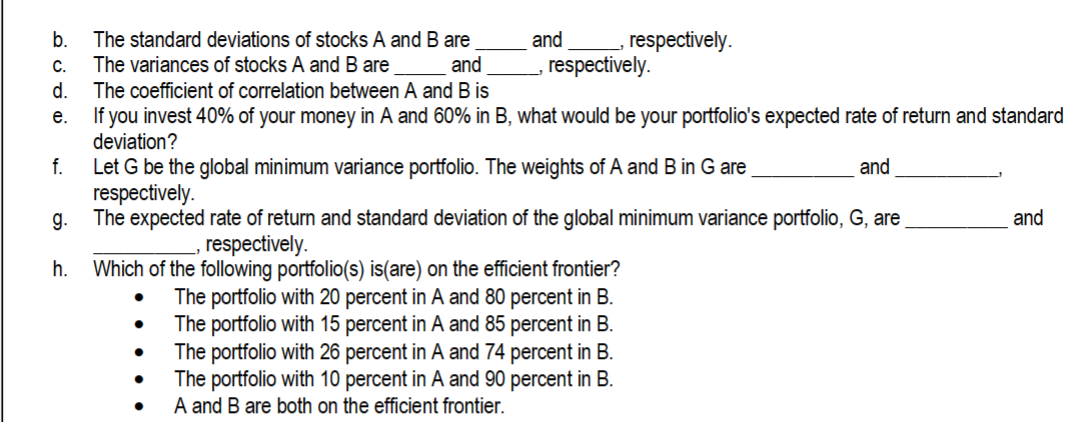

Q\#9: Chapter 07: Consider the following probability distribution for stocks A and B: a. The expected rates of return of stocks A and B are and respectively. b. The standard deviations of stocks A and B are and , respectively. c. The variances of stocks A and B are and , respectively. d. The coefficient of correlation between A and B is e. If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation? f. Let G be the global minimum variance portfolio. The weights of A and B in G are and respectively. g. The expected rate of return and standard deviation of the global minimum variance portfolio, G, are and , respectively. h. Which of the following portfolio(s) is(are) on the efficient frontier? - The portfolio with 20 percent in A and 80 percent in B. - The portfolio with 15 percent in A and 85 percent in B. - The portfolio with 26 percent in A and 74 percent in B. - The portfolio with 10 percent in A and 90 percent in B. - A and B are both on the efficient frontier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts