Question: Qa. Realized Returns An active equity mutual fund generated a series of good returns during the past four years: Yeart Year 1 Year 2 Year

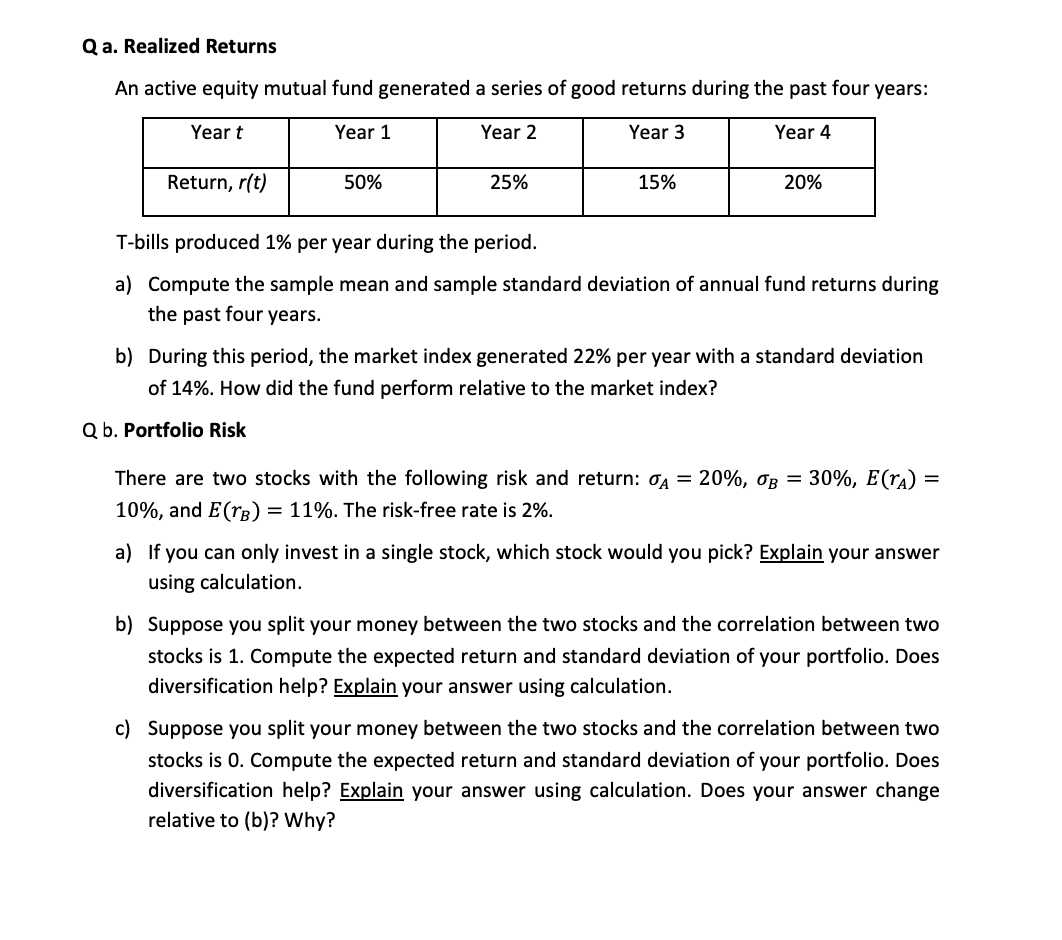

Qa. Realized Returns An active equity mutual fund generated a series of good returns during the past four years: Yeart Year 1 Year 2 Year 3 Year 4 Return, r(t) 50% 25% 15% 20% T-bills produced 1% per year during the period. a) Compute the sample mean and sample standard deviation of annual fund returns during the past four years. b) During this period, the market index generated 22% per year with a standard deviation of 14%. How did the fund perform relative to the market index? Q b. Portfolio Risk There are two stocks with the following risk and return: A = 20%, OB = 30%, E(ra) = 10%, and E(TB) = 11%. The risk-free rate is 2%. a) If you can only invest in a single stock, which stock would you pick? Explain your answer using calculation. b) Suppose you split your money between the two stocks and the correlation between two stocks is 1. Compute the expected return and standard deviation of your portfolio. Does diversification help? Explain your answer using calculation. c) Suppose you split your money between the two stocks and the correlation between two stocks is 0. Compute the expected return and standard deviation of your portfolio. Does diversification help? Explain your answer using calculation. Does your answer change relative to (b)? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts