Question: QE Basic Cross Rates Sheet3 Problem 17-1: Multinational Financial Management Financial Management: Theory and Practice A currency trader observes that, in the spot exchange market,

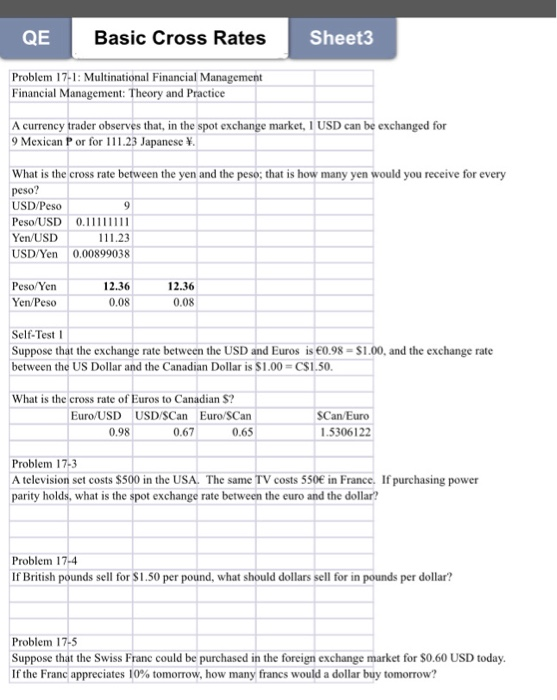

QE Basic Cross Rates Sheet3 Problem 17-1: Multinational Financial Management Financial Management: Theory and Practice A currency trader observes that, in the spot exchange market, 1 USD can be exchanged for 9 Mexican P or for 111.23 Japanese . What is the cross rate between the yen and the peso; that is how many yen would you receive for every peso? USD/Peso Peso/USD 0.1111111 Yen/USD 111.23 USD/Yen 0.00899038 Peso/Yen Yen/Peso 12.36 0.08 OS 12.36 0.08 Self-Test 1 Suppose that the exchange rate between the USD and Euros is 0.98 - $1.00, and the exchange rate between the US Dollar and the Canadian Dollar is $1.00 = C$1.50. What is the cross rate of Euros to Canadian S? Euro/USD USD/SCan Euro/SCan 0.98 0.67 0.65 SCan Euro 1.5306122 Problem 17-3 A television set costs $500 in the USA. The same TV costs 550 in France. If purchasing power parity holds, what is the spot exchange rate between the euro and the dollar? Problem 17-4 If British pounds sell for $1.50 per pound, what should dollars sell for in pounds per dollar? Problem 17-5 Suppose that the Swiss Franc could be purchased in the foreign exchange market for $0.60 USD today. If the Franc appreciates 10% tomorrow, how many francs would a dollar buy tomorrow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts