Question: QJ) Selected sales and operating data for three different companies are given bellow. 1. Compute the return on investment (ROI) for each division. (5 points)

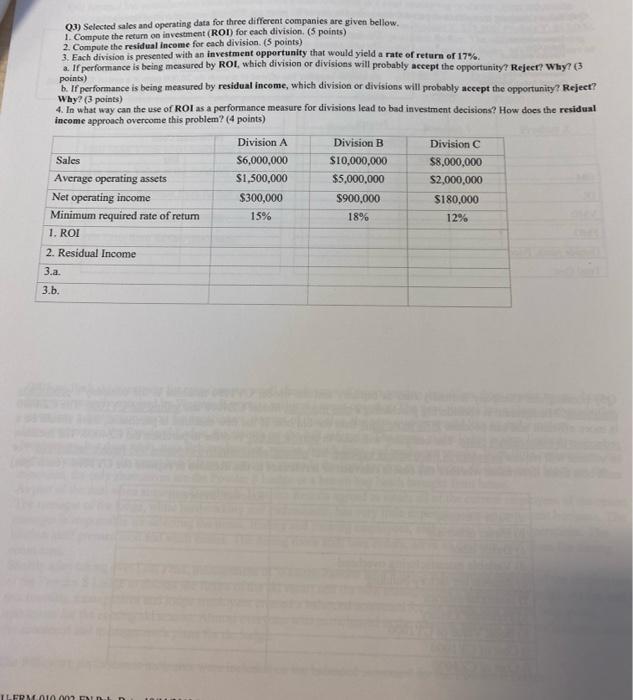

QJ) Selected sales and operating data for three different companies are given bellow. 1. Compute the return on investment (ROI) for each division. (5 points) 2. Compute the residual income for each division (5 points) 3. Each division is presented with an investment opportunity that would yield a rate of return of 17% If performance is being measured by ROI, which division or divisions will probably accept the opportunity? Reject? Why? (3 points) b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Reject? Why? (3 points) 4. In what way can the use of ROI as a performance measure for divisions lead to bad investment decisions? How does the residual income approach overcome this problem? (4 points) Sales Average operating assets Net operating income Minimum required rate of retum 1. ROI Division A $6,000,000 $1,500,000 $300,000 15% Division B $10,000,000 $5,000,000 $900,000 18% Division $8,000,000 $2,000,000 $180,000 12% 2. Residual Income 3.a. 3.b. ILERMOME

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts