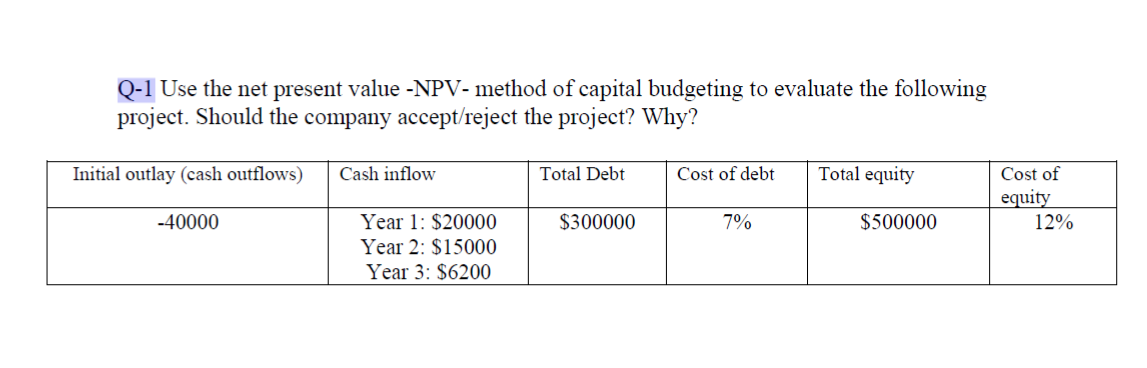

Question: Q-l Use the net present value -NPV- method of capital budgeting to evaluate the following project. Should the company accepts'reject the proj eet'?I Why? Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts