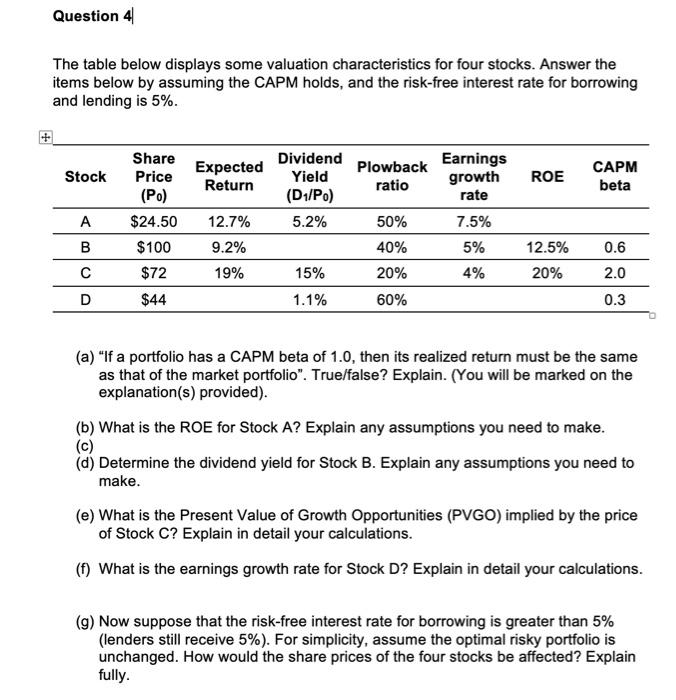

Question: qn a b and only Question 4 The table below displays some valuation characteristics for four stocks. Answer the items below by assuming the CAPM

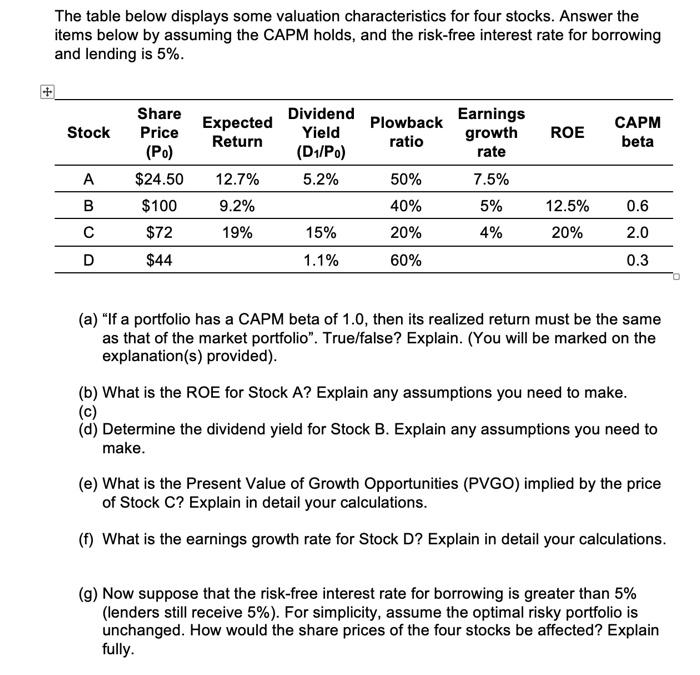

Question 4 The table below displays some valuation characteristics for four stocks. Answer the items below by assuming the CAPM holds, and the risk-free interest rate for borrowing and lending is 5%. Stock Expected Return Plowback ratio ROE Dividend Yield (D1/P.) 5.2% Share Price (Po) $24.50 $100 CAPM beta Earnings growth rate 7.5% 5% A 12.7% 9.2% B 0.6 50% 40% 20% 60% 12.5% 20% $72 19% 15% 4% 2.0 0.3 D $44 1.1% (a) "If a portfolio has a CAPM beta of 1.0, then its realized return must be the same as that of the market portfolio". True/false? Explain. (You will be marked on the explanation(s) provided). (b) What is the ROE for Stock A? Explain any assumptions you need to make. (c) (d) Determine the dividend yield for Stock B. Explain any assumptions you need to make. (e) What is the Present Value of Growth Opportunities (PVGO) implied by the price of Stock C? Explain in detail your calculations. (1) What is the earnings growth rate for Stock D? Explain in detail your calculations. (9) Now suppose that the risk-free interest rate for borrowing is greater than 5% (lenders still receive 5%). For simplicity, assume the optimal risky portfolio is unchanged. How would the share prices of the four stocks be affected? Explain fully. The table below displays some valuation characteristics for four stocks. Answer the items below by assuming the CAPM holds, and the risk-free interest rate for borrowing and lending is 5%. Stock Share Price (Po) $24.50 Expected Return ROE Dividend Yield (D1/P.) 5.2% Plowback ratio CAPM beta Earnings growth rate 7.5% 5% 50% A B C 12.7% 9.2% 40% 12.5% 0.6 $100 $72 19% 15% 20% 4% 20% 2.0 D $44 1.1% 60% 0.3 (a) "If a portfolio has a CAPM beta of 1.0, then its realized return must be the same as that of the market portfolio". True/false? Explain. (You will be marked on the explanation(s) provided). (b) What is the ROE for Stock A? Explain any assumptions you need to make. (c) (d) Determine the dividend yield for Stock B. Explain any assumptions you need to make. (e) What is the Present Value of Growth Opportunities (PVGO) implied by the price of Stock C? Explain in detail your calculations. (f) What is the earnings growth rate for Stock D? Explain in detail your calculations. (9) Now suppose that the risk-free interest rate for borrowing is greater than 5% (lenders still receive 5%). For simplicity, assume the optimal risky portfolio is unchanged. How would the share prices of the four stocks be affected? Explain fully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts