Question: Q.No.1 you are required to perform Vertical analysis for both the statement (provided above). Analyze both the statements, provide interpretation and a comprehensive judgement as

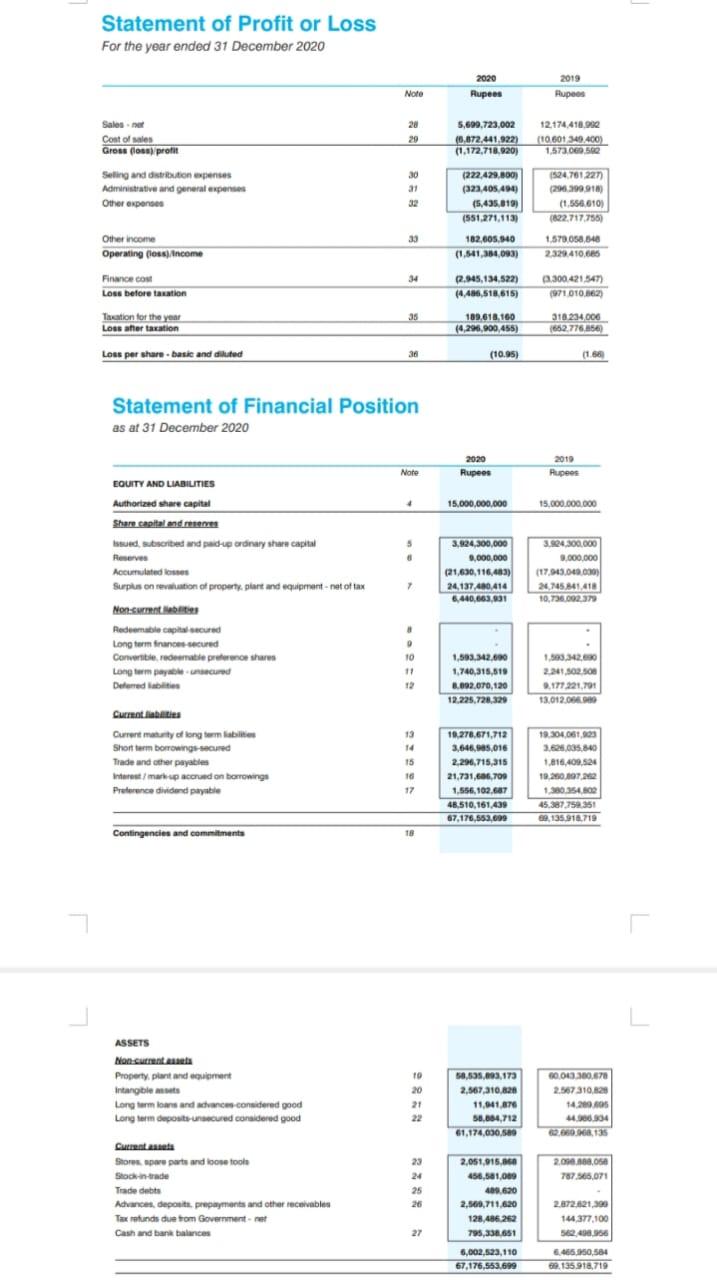

Q.No.1 you are required to perform Vertical analysis for both the statement (provided above). Analyze both the statements, provide interpretation and a comprehensive judgement as if the company is lucrative for the purpose of investment for the investors or not.

Q.No.2 you are required to perform Horizontal analysis for both the statement (provided above). Analyze both the statements, provide interpretation and a comprehensive judgement as if the company is lucrative for the purpose of investment for the investors or not.

Q.No.3. one of the most important purposes of applying different techniques on the financial statements is to check if there is any irregularity highlighted by the analysis. Note any divergence in the results you find after you are done with your analysis. Also note, if there is no divergence and both tools are showing results in the same direction and you are reaching at the same conclusion after performing both techniques.

Statement of Profit or Loss For the year ended 31 December 2020 2020 Rupees 2019 Rupees Note Sales Cost of sales Gross (0) Profit 29 5,699,723.002 (0.672.441 922) (1,172,718.920) 12.174.418.900 (10 601 340.400) 1.573.06 500 Seling and distribution expenses Administrative and general expenses Other expenses 21 (222.429.300) (323.405.490 (5,435.819 (551.271,113) 524 761 227 (296.399.918 (1.556.610) (822.717.756) 32 33 Other income Operating lossIncome ( 182.605.940 (1.41,384 093) 1.570 058,340 2.329.410.6 34 Finance cos Loss before taxation 2.945,134,522) (4.486,518,615) 2.300 421 547) 1971 10.162) Tacation for the year Loss after taxation 109.618.160 (4,296,900,455) 318234000 1652 776 56 Los per share base and diluted - 30 (10.95) (1.58 Statement of Financial Position as at 31 December 2020 2020 Rupees 2019 Rupees Note EQUITY AND LIABILITIES Authorized share capital 1 15,000,000,000 15.000.000.000 Share capital and reserves issued subscribe and paidu ardinary share capital , Reserves Accumulated kisses Surplus on revolution of property, plant and equipment-net of tax 3.924,300,000 9,000,000 (21,690,116,483) 24.137.400.414 6,440,663,931 31824.300.000 9.000.000 (17.03.00.000 2,745.861.418 10.73609237 Non-sures 0 10 11 12 1.593.342.600 1.740.315,810 8.092,070, 120 12.225.728.329 1593342.690 2.24.502.00 2.177 221.791 13.012.GO Redeemable cured Long term france-secured Convertible, redeuralle preference shares Long term parcured Deferred abiti Current liabilities Current mounty of long term biti Short term borrowing secured Trade and other payable Interest mark cordon borrowing Preference dividend payable 13 14 15 10 17 19.278.671,712 3,646.05.016 2.296,715,315 21,731,606,709 1.556.102.687 48,510,161.439 67,176,553,699 19.304.061,923 3.624.035.840 1816.409524 19.260.1972 1380.354502 45.38775351 69,135 916719 Contingencies and commitments 18 ASSETS Non current Property, plant and en Intangiblemets Long terms and coconuidered good Long term depostsecured considered good 10 20 50.535,003,173 2.567.310.26 11.041.676 50.084,712 61,174,030.00 00013 30.670 2.567 310 14.20 4394 2.0 AB,050 787.506,071 Stores are parts and one tool Stock-in-trade Trade debits Advances deposits prepayments and other receivable Tax refunds due tom Government et Cash and bank balances 23 24 25 26 2,051,015.GO 456,501.09 409620 2.500,711.620 128.486.262 795,338.651 6,002,523,110 67,176,553.699 2.872.621.390 144 377.100 562.490.956 27 6.466.050,584 6.135.918.719 Statement of Profit or Loss For the year ended 31 December 2020 2020 Rupees 2019 Rupees Note Sales Cost of sales Gross (0) Profit 29 5,699,723.002 (0.672.441 922) (1,172,718.920) 12.174.418.900 (10 601 340.400) 1.573.06 500 Seling and distribution expenses Administrative and general expenses Other expenses 21 (222.429.300) (323.405.490 (5,435.819 (551.271,113) 524 761 227 (296.399.918 (1.556.610) (822.717.756) 32 33 Other income Operating lossIncome ( 182.605.940 (1.41,384 093) 1.570 058,340 2.329.410.6 34 Finance cos Loss before taxation 2.945,134,522) (4.486,518,615) 2.300 421 547) 1971 10.162) Tacation for the year Loss after taxation 109.618.160 (4,296,900,455) 318234000 1652 776 56 Los per share base and diluted - 30 (10.95) (1.58 Statement of Financial Position as at 31 December 2020 2020 Rupees 2019 Rupees Note EQUITY AND LIABILITIES Authorized share capital 1 15,000,000,000 15.000.000.000 Share capital and reserves issued subscribe and paidu ardinary share capital , Reserves Accumulated kisses Surplus on revolution of property, plant and equipment-net of tax 3.924,300,000 9,000,000 (21,690,116,483) 24.137.400.414 6,440,663,931 31824.300.000 9.000.000 (17.03.00.000 2,745.861.418 10.73609237 Non-sures 0 10 11 12 1.593.342.600 1.740.315,810 8.092,070, 120 12.225.728.329 1593342.690 2.24.502.00 2.177 221.791 13.012.GO Redeemable cured Long term france-secured Convertible, redeuralle preference shares Long term parcured Deferred abiti Current liabilities Current mounty of long term biti Short term borrowing secured Trade and other payable Interest mark cordon borrowing Preference dividend payable 13 14 15 10 17 19.278.671,712 3,646.05.016 2.296,715,315 21,731,606,709 1.556.102.687 48,510,161.439 67,176,553,699 19.304.061,923 3.624.035.840 1816.409524 19.260.1972 1380.354502 45.38775351 69,135 916719 Contingencies and commitments 18 ASSETS Non current Property, plant and en Intangiblemets Long terms and coconuidered good Long term depostsecured considered good 10 20 50.535,003,173 2.567.310.26 11.041.676 50.084,712 61,174,030.00 00013 30.670 2.567 310 14.20 4394 2.0 AB,050 787.506,071 Stores are parts and one tool Stock-in-trade Trade debits Advances deposits prepayments and other receivable Tax refunds due tom Government et Cash and bank balances 23 24 25 26 2,051,015.GO 456,501.09 409620 2.500,711.620 128.486.262 795,338.651 6,002,523,110 67,176,553.699 2.872.621.390 144 377.100 562.490.956 27 6.466.050,584 6.135.918.719

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts