Question: Qoestion B (45%) Using the information below, answer the following questions Carry all the answers to two decimal points, unless otherwise specified. E.g. $12.34 or

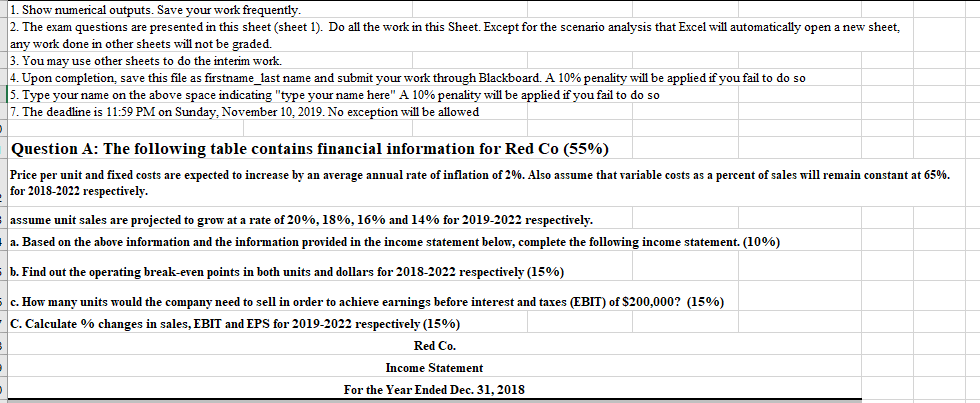

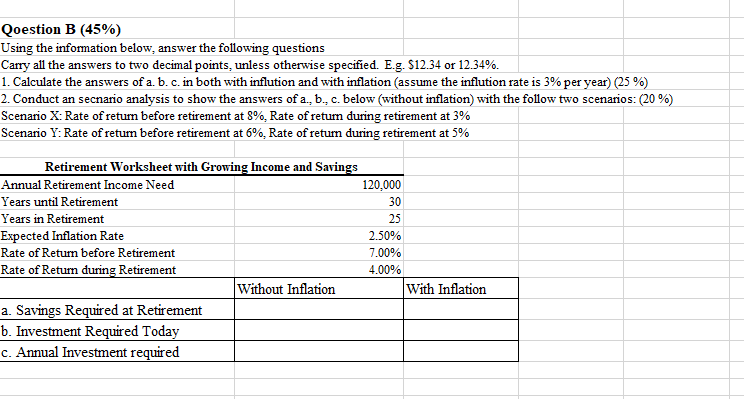

Qoestion B (45%) Using the information below, answer the following questions Carry all the answers to two decimal points, unless otherwise specified. E.g. $12.34 or 12.34%. 1. Calculate the answers of a. b. c. in both with inflution and with inflation (assume the inflution rate is 3% per year) (25%) 2. Conduct an secnario analysis to show the answers of a., 6., c. below (without inflation) with the follow two scenarios: (20%) Scenario X: Rate of return before retirement at 8%, Rate of return during retirement at 3% Scenario Y: Rate of return before retirement at 6%, Rate of retum during retirement at 5% Retirement Worksheet with Growing Income and Savings Annual Retirement Income Need 120.000 Years until Retirement 30 Years in Retirement Expected Inflation Rate 2.50% Rate of Return before Retirement 7.00% Rate of Retum during Retirement 4.00% Without Inflation With Inflation a. Savings Required at Retirement b. Investment Required Today c. Annual Investment required Qoestion B (45%) Using the information below, answer the following questions Carry all the answers to two decimal points, unless otherwise specified. E.g. $12.34 or 12.34%. 1. Calculate the answers of a. b. c. in both with inflution and with inflation (assume the inflution rate is 3% per year) (25%) 2. Conduct an secnario analysis to show the answers of a., 6., c. below (without inflation) with the follow two scenarios: (20%) Scenario X: Rate of return before retirement at 8%, Rate of return during retirement at 3% Scenario Y: Rate of return before retirement at 6%, Rate of retum during retirement at 5% Retirement Worksheet with Growing Income and Savings Annual Retirement Income Need 120.000 Years until Retirement 30 Years in Retirement Expected Inflation Rate 2.50% Rate of Return before Retirement 7.00% Rate of Retum during Retirement 4.00% Without Inflation With Inflation a. Savings Required at Retirement b. Investment Required Today c. Annual Investment required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts