Question: QS 14-11 Computing payments for an installment note LO C1 On January 1, 2017, MM Co. borrows $380,000 cash from a bank and in return

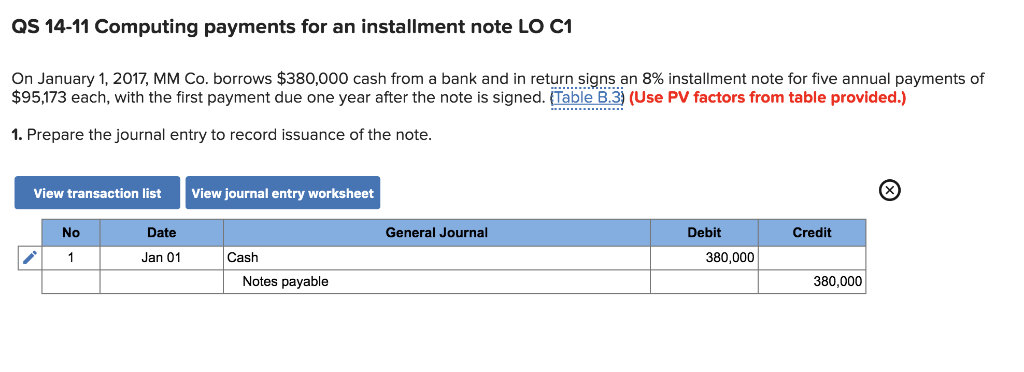

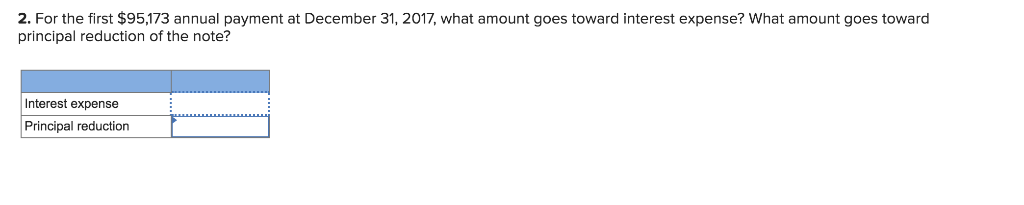

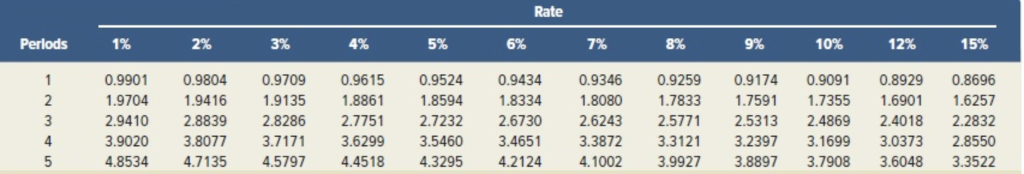

QS 14-11 Computing payments for an installment note LO C1 On January 1, 2017, MM Co. borrows $380,000 cash from a bank and in return signs an 8% installment note for five annual payments of $95,173 each, with the first payment due one year after the note is signed. Table B.3) (Use PV factors from table provided.) 1. Prepare the journal entry to record issuance of the note. View transaction list View journal entry worksheet No Date General Journal Debit Credit Jan 01 380,000 1 Cash Notes payable 380,000 2. For the first $95,173 annual payment at December 31, 2017, what amount goes toward interest expense? What amount goes toward principal reduction of the note? Interest expense Principal reduction Rate Perlods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 1.9704 1.9416 1.9135 1.886 1 1.8334 1.8080 1.7833 1.7591 1.6901 2 1.8594 1.7355 1.6257 3 2.8839 2.6730 2.9410 2.8286 2.775 2.7232 2.6243 2.5771 2.5313 2.4869 2.4018 2.2832 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.0373 2.8550 4.7135 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6048 3.3522 5 4.8534

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts