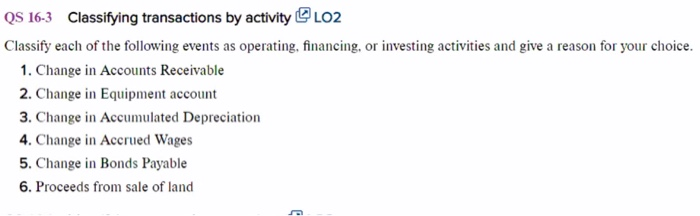

Question: QS 16-3 Classifying transactions by activity L02 Classify each of the following events as operating, financing, or investing activities and give a reason for your

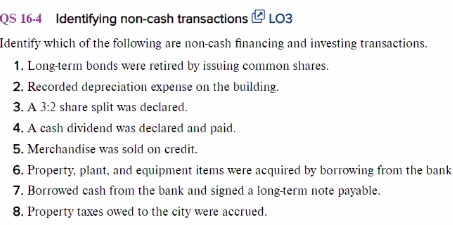

QS 16-3 Classifying transactions by activity L02 Classify each of the following events as operating, financing, or investing activities and give a reason for your choice. 1. Change in Accounts Receivable 2. Change in Equipment account 3. Change in Accumulated Depreciation 4. Change in Accrued Wages 5. Change in Bonds Payable 6. Proceeds from sale of land 5 "QS 16-4 Identifying non-cash transactions L03 Identify which of the following are non-cash financing and investing transactions. 1. Long-term bonds were retired by issuing common shares. 2. Recorded depreciation expense on the building. 3. A 3:2 share split was declared. 4. A cash dividend was declared and paid. 5. Merchandise was sold on credit. 6. Property, plant, and equipment items were acquired by borrowing from the bank 7. Borrowed cash from the bank and signed a long-term note payable. 8. Property taxes owed to the city were accrued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts