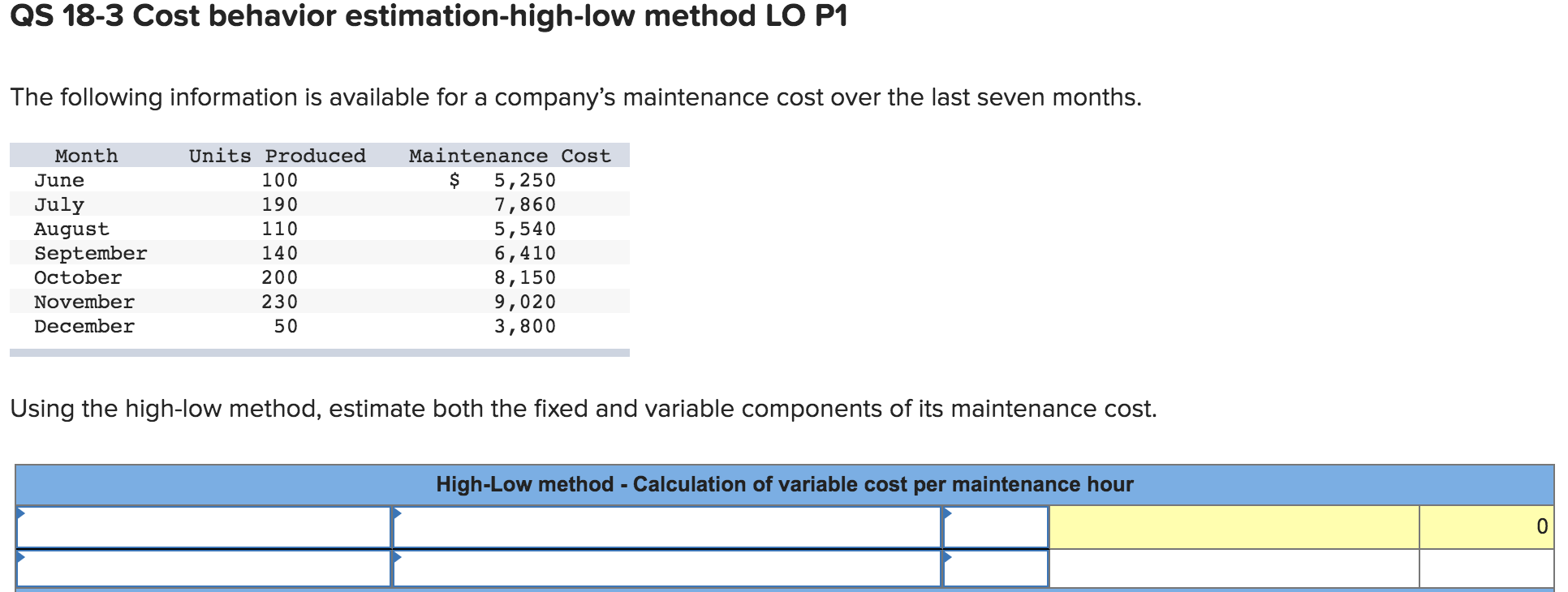

Question: QS 18-3 Cost behavior estimation-high-low method LO P1 The following information is available for a company's maintenance cost over the last seven months. Month June

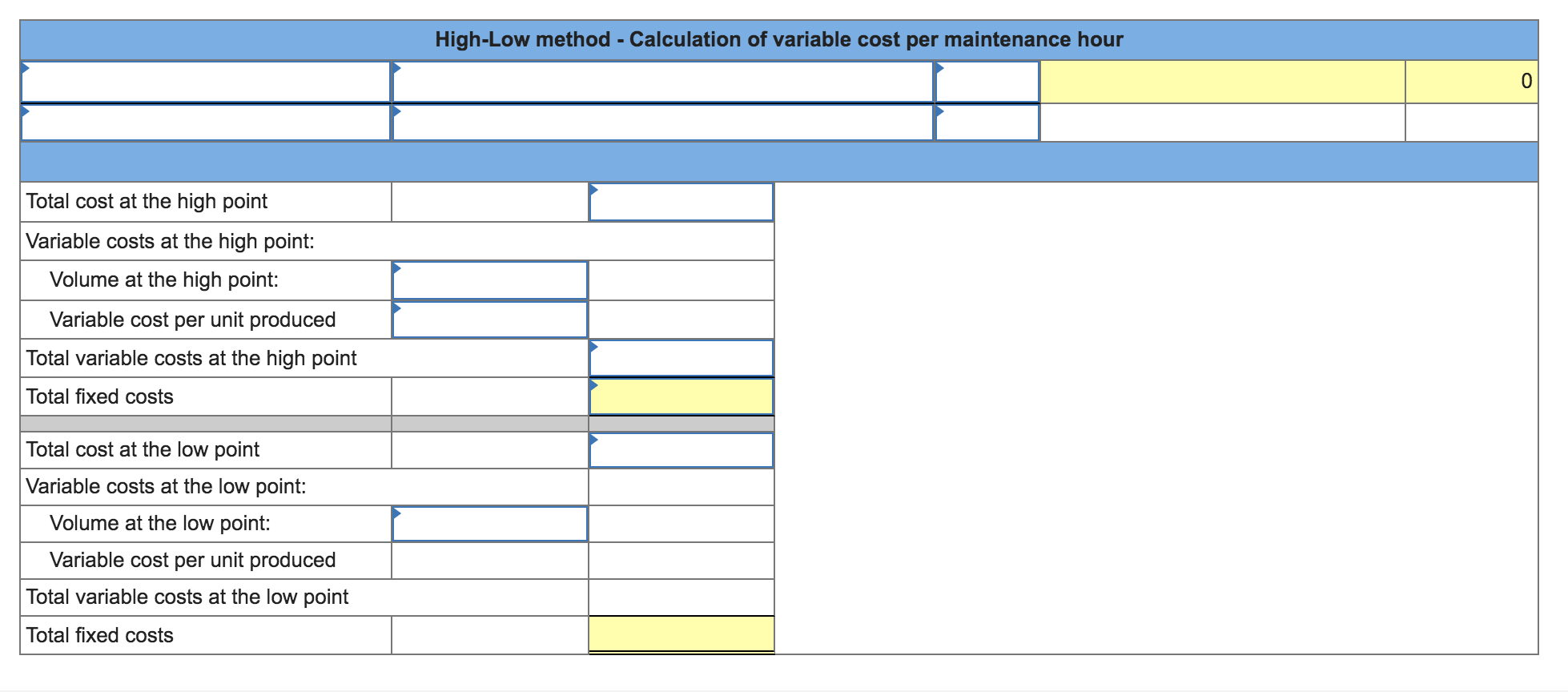

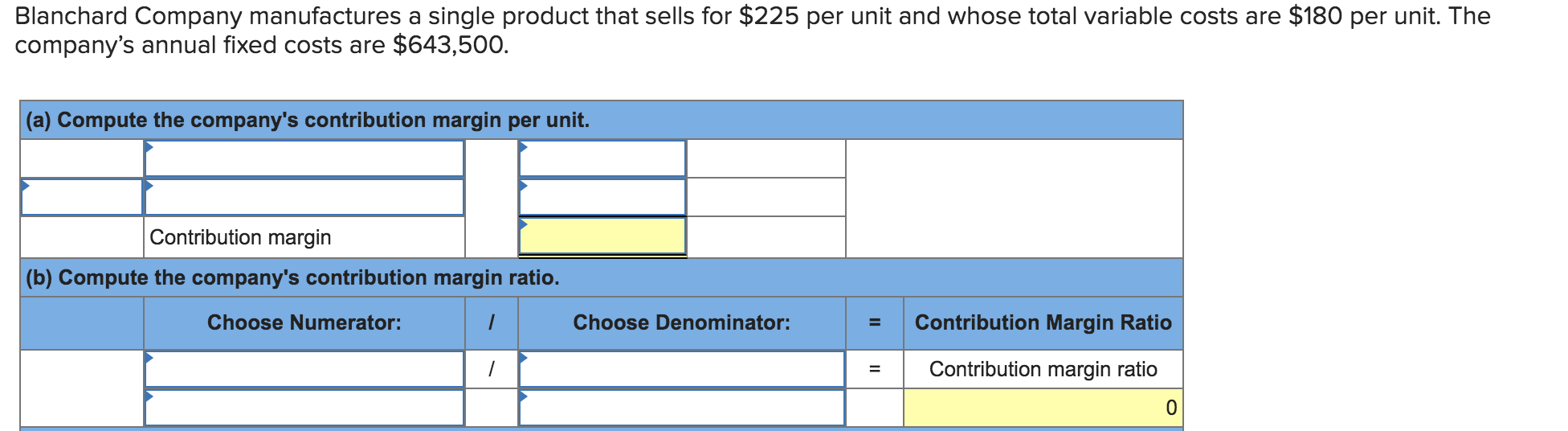

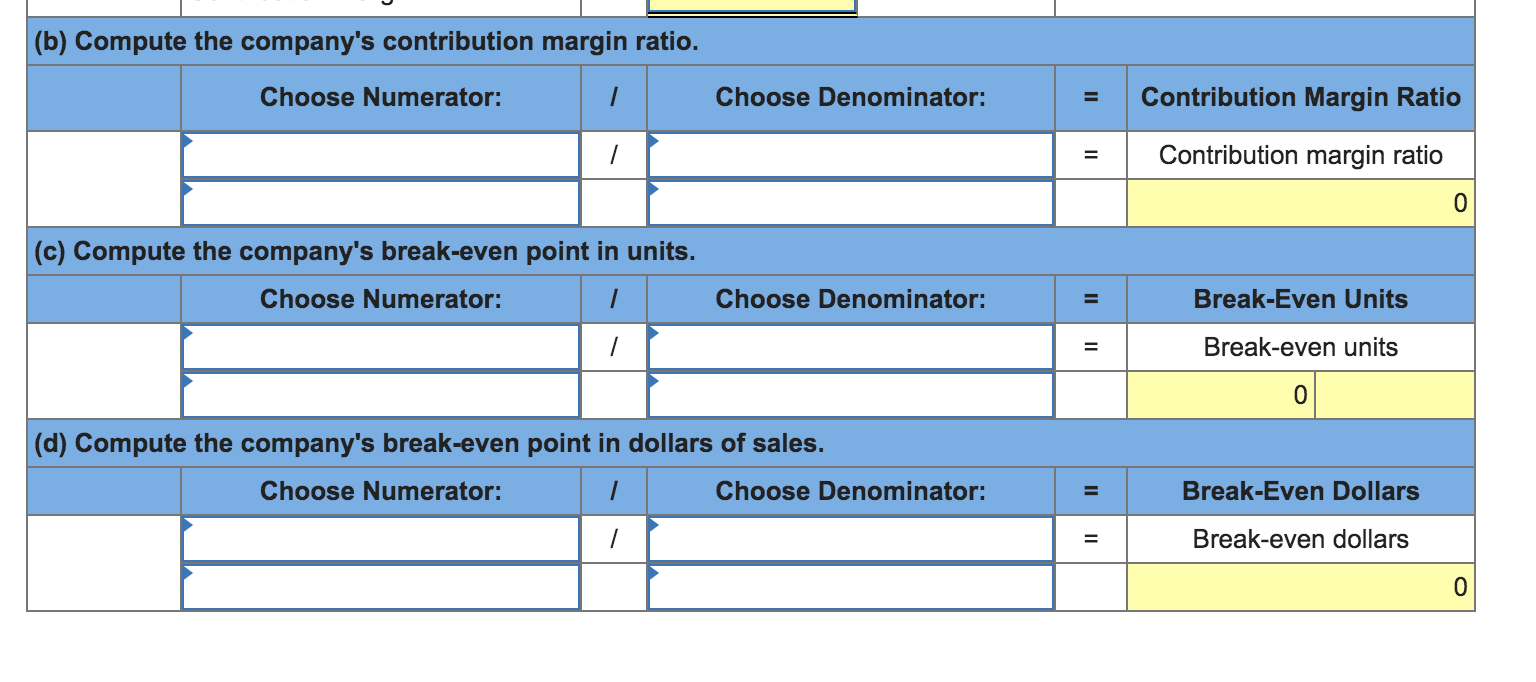

QS 18-3 Cost behavior estimation-high-low method LO P1 The following information is available for a company's maintenance cost over the last seven months. Month June July August September October November December Units Produced 100 190 110 140 200 230 50 Maintenance Cost 5,250 7,860 5,540 6,410 8,150 9,020 3,800 Using the high-low method, estimate both the fixed and variable components of its maintenance cost. High-Low method - Calculation of variable cost per maintenance hour 0 High-Low method - Calculation of variable cost per maintenance hour O Total cost at the high point Variable costs at the high point: Volume at the high point: Variable cost per unit produced Total variable costs at the high point Total fixed costs Total cost at the low point Variable costs at the low point: Volume at the low point: Variable cost per unit produced Total variable costs at the low point Total fixed costs Blanchard Company manufactures a single product that sells for $225 per unit and whose total variable costs are $180 per unit. The company's annual fixed costs are $643,500. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. Choose Numerator: Choose Denominator: = Contribution Margin Ratio Contribution margin ratio 0 (b) Compute the company's contribution margin ratio. Choose Numerator: Choose Denominator: Contribution Margin Ratio II Contribution margin ratio 0 (c) Compute the company's break-even point in units. Choose Numerator: Choose Denominator: II Break-Even Units II Break-even units 0 (d) Compute the company's break-even point in dollars of sales. Choose Numerator: Choose Denominator: Break-Even Dollars Break-even dollars 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts