Question: QS 2 - 1 6 ( Algo ) Preparing and interpreting job cost sheet LO P 1 , P 2 , P 3 A company

QS Algo Preparing and interpreting job cost sheet LO P P P

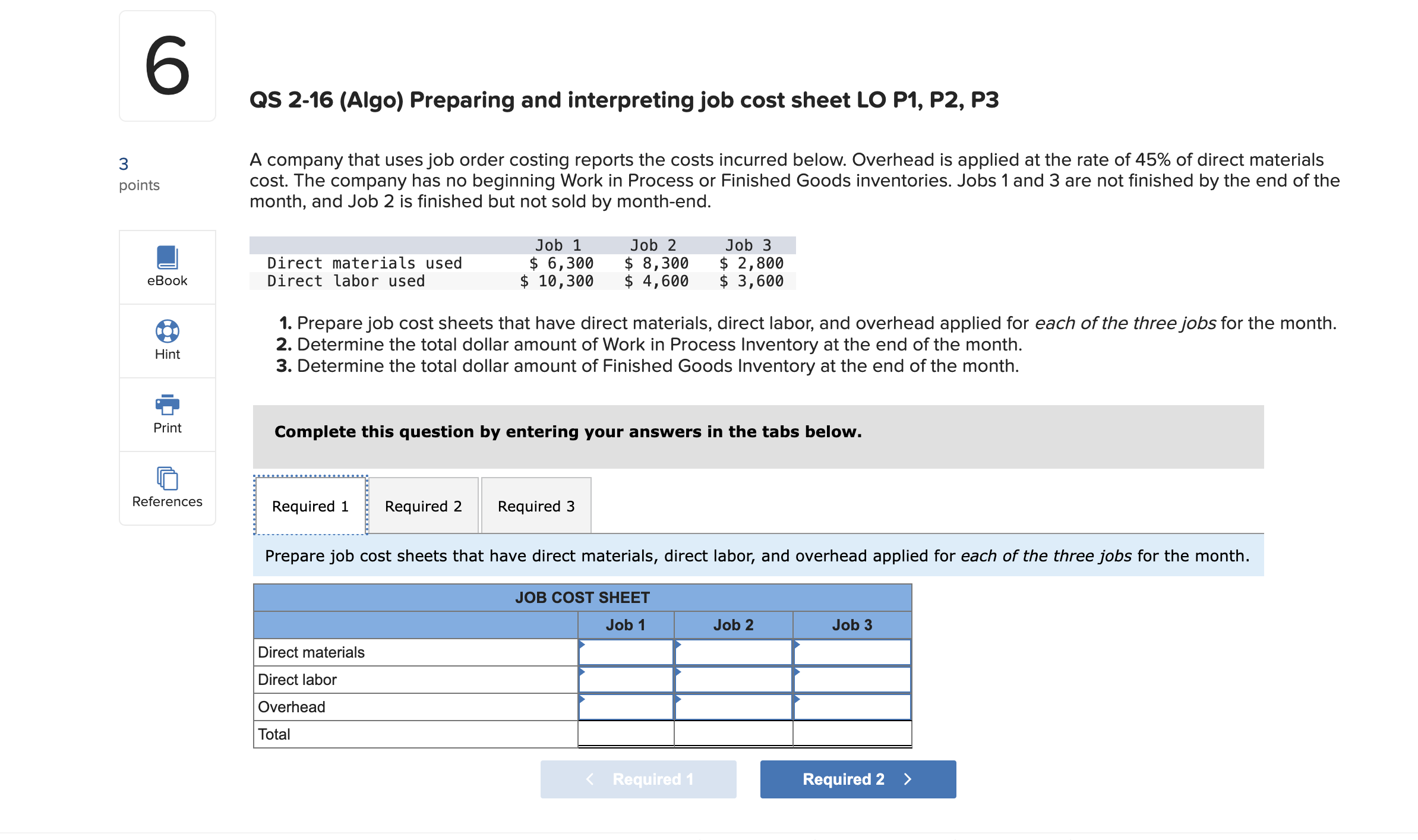

A company that uses job order costing reports the costs incurred below. Overhead is applied at the rate of of direct materials cost. The company has no beginning Work in Process or Finished Goods inventories. Jobs and are not finished by the end of the month, and Job is finished but not sold by monthend.

Prepare job cost sheets that have direct materials, direct labor, and overhead applied for each of the three jobs for the month.

Determine the total dollar amount of Work in Process Inventory at the end of the month.

Determine the total dollar amount of Finished Goods Inventory at the end of the month.

Complete this question by entering your answers in the tabs below.

Required

Required

Required

Prepare job cost sheets that have direct materials, direct labor, and overhead applied for each of the three jobs for the month.

QS Algo Preparing and interpreting job cost sheet LO P P P

A company that uses job order costing reports the costs incurred below. Overhead is applied at the rate of of direct materials cost. The company has no beginning Work in Process or Finished Goods inventories. Jobs and are not finished by the end of the month, and Job is finished but not sold by monthend.

Prepare job cost sheets that have direct materials, direct labor, and overhead applied for each of the three jobs for the month.

Determine the total dollar amount of Work in Process Inventory at the end of the month.

Determine the total dollar amount of Finished Goods Inventory at the end of the month.

Complete this question by entering your answers in the tabs below.

Required

Required

Determine the total dollar amount of Work in Process Inventory at the end of the month.

Work in process inventory QS Algo Preparing and interpreting job cost sheet LO P P P

A company that uses job order costing reports the costs incurred below. Overhead is applied at the rate of of direct materials cost. The company has no beginning Work in Process or Finished Goods inventories. Jobs and are not finished by the end of the month, and Job is finished but not sold by monthend.

Prepare job cost sheets that have direct materials, direct labor, and overhead applied for each of the three jobs for the month.

Determine the total dollar amount of Work in Process Inventory at the end of the month.

Determine the total dollar amount of Finished Goods Inventory at the end of the month.

Complete this question by entering your answers in the tabs below.

Required

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock