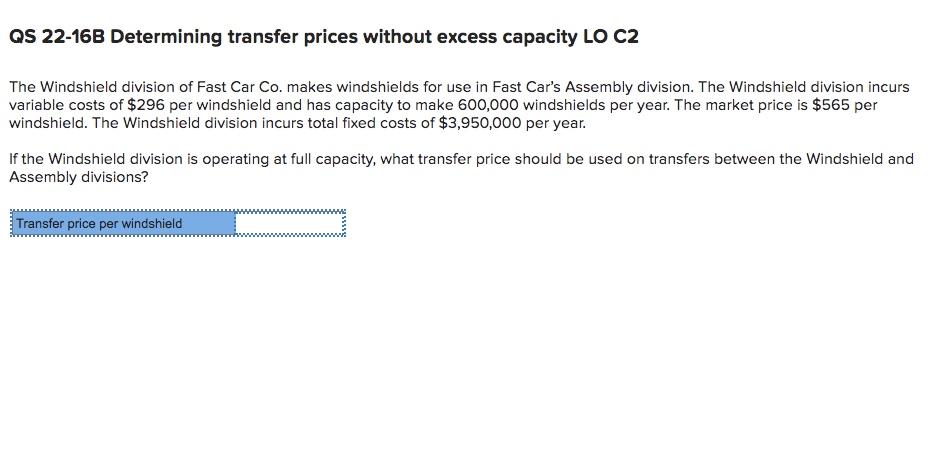

Question: QS 22-16B Determining transfer prices without excess capacity LO C2 The Windshield division of Fast Car Co. makes windshields for use in Fast Car's Assembly

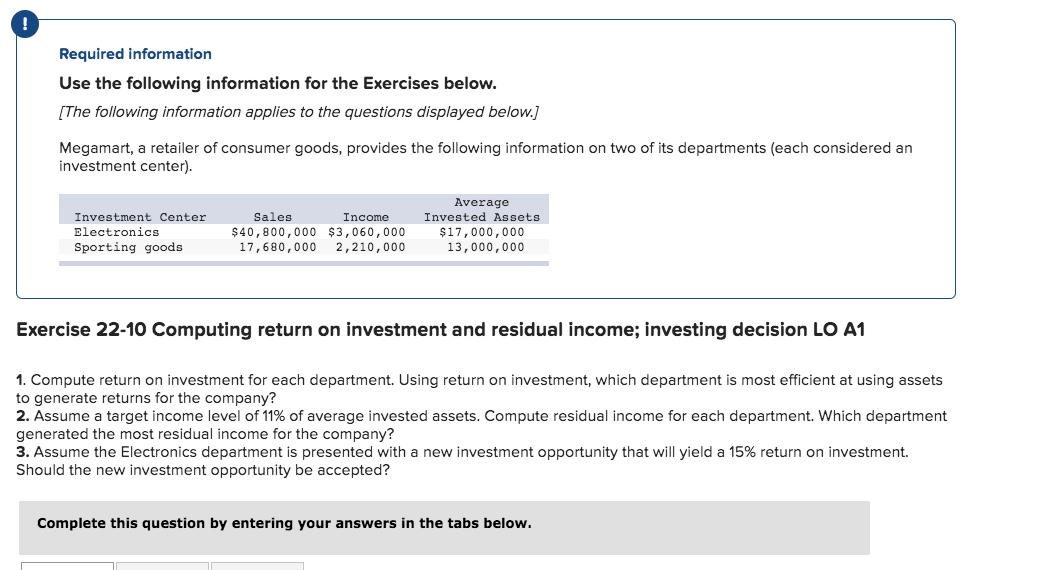

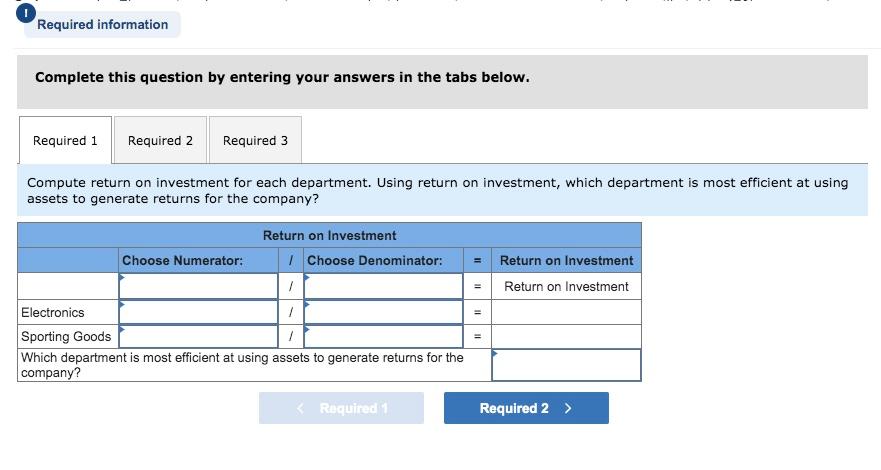

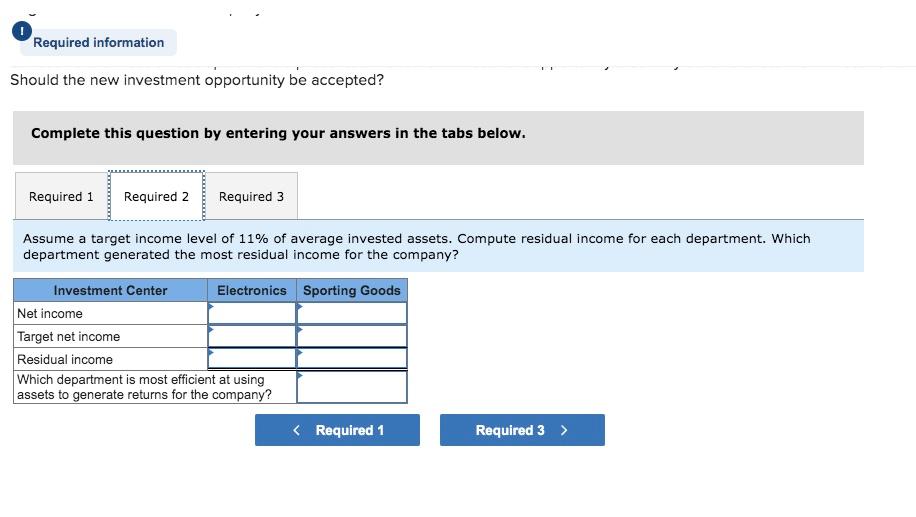

QS 22-16B Determining transfer prices without excess capacity LO C2 The Windshield division of Fast Car Co. makes windshields for use in Fast Car's Assembly division. The Windshield division incurs variable costs of $296 per windshield and has capacity to make 600,000 windshields per year. The market price is $565 per windshield. The Windshield division incurs total fixed costs of $3,950,000 per year. If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions? Transfer price per windshield Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.) Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Investment Center Electronics Sporting goods Sales Income $40,800,000 $3,060,000 17,680,000 2,210,000 Average Invested Assets $17,000,000 13,000,000 Exercise 22-10 Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted? Complete this question by entering your answers in the tabs below. Required information Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? II Return on Investment Return on Investment 11 Return on Investment Choose Numerator: 1 Choose Denominator: 1 Electronics / Sporting Goods Which department is most efficient at using assets to generate returns for the company? II Required information Should the new investment opportunity be accepted? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? Investment Center Electronics Sporting Goods Net income Target net income Residual income Which department is most efficient at using assets to generate returns for the company? LUAVRICA *11nramnitina A+ In an inuncement and rACIA alinama. Inuinetinn ARICIANIMA Required information 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted? Should the new investment opportunity be accepted?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts