Question: QS. 2-5 QUICK STUDY QS 2-1 Identifying source documents C1 Identify the items from the following list that are likely to serve as source document

QS. 2-5

QS. 2-5

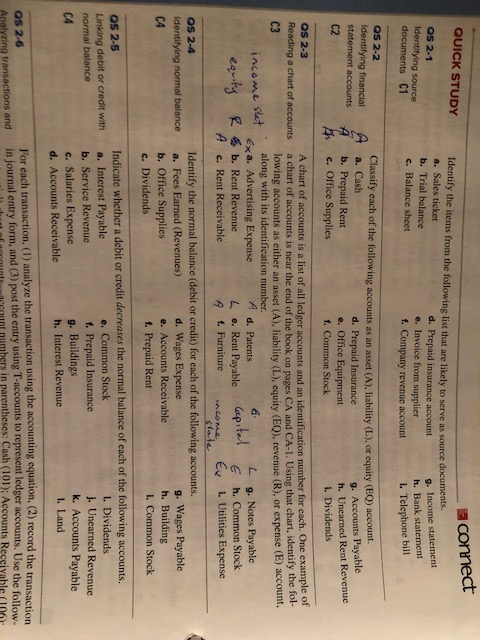

QUICK STUDY QS 2-1 Identifying source documents C1 Identify the items from the following list that are likely to serve as source document a. Sales ticket b. Trial balance c. Balance sheet d. Prepaid insurance account e. Invoice from supplier f. Company revenue account g. Income statement h. Bank statement i. Telephone bill Qs 2-2 Identifying financial statement accontsb. Prepaid Rent Classify each of the following accounts as an asset a. Cash (A), liability (L), or equity (EQ) account. d. Prepaid Insurance e. Office Equipment f. Common Stock g. Accounts Payable h. Unearned Rent Revenue i. Dividends Qs 2-3 Reading a chart of accounts C3 c. Office Supplies A chart of accounts is a list of all ledger accounts and an identification number for each. One example o lowing accounts as either an asset (A), liability (L), equity (EQ). revenue (R), or expense (E) account. a chart of accounts is near the end of the book on pages CA and CA-1. Using that chart, identify the tol along with its identification number Ex a. Advertising Expense & b. Rent Revenue A d. Patents L e. Rent Payable sp L g. Notes Payable E h. Common Stock A c. Rent Receivable f. Furniture ncOMaEv i. Utilities Expense os 2-4 dentifying normal balance a. Fees Earned (Revenues) C4 Identify the normal balance (debit or credit) for each of the following accounts. b. Office Supplies c. Dividends d. Wages Expense e. Accounts Receivable f. Prepaid Rent g. Wages Payable h. Building i. Common Stock os 2-5 Linking debit or credit with normal balance C4 Indicate whether a debit or credit decreases the normal balance of each of the following accounts. a. Interest Payable b. Service Revenue c. Salaries Expense d. Accounts Receivable e. Common Stock f. Prepaid Insurance g. Buildings h. Interest Revenue l. Dividends j. Unearned Revenue k. Accounts Payable l. Land record the transaction accounts. Use the follow- For each transaction, (1) analyze the transaction using the accounting equation, (2) os 2-6 nalyzing transactions and in journal entry form, and (3) post the entry using T-accounts to represent ledger ac count numbers in parentheses: Cash (101); Accounts Receivable (106

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts