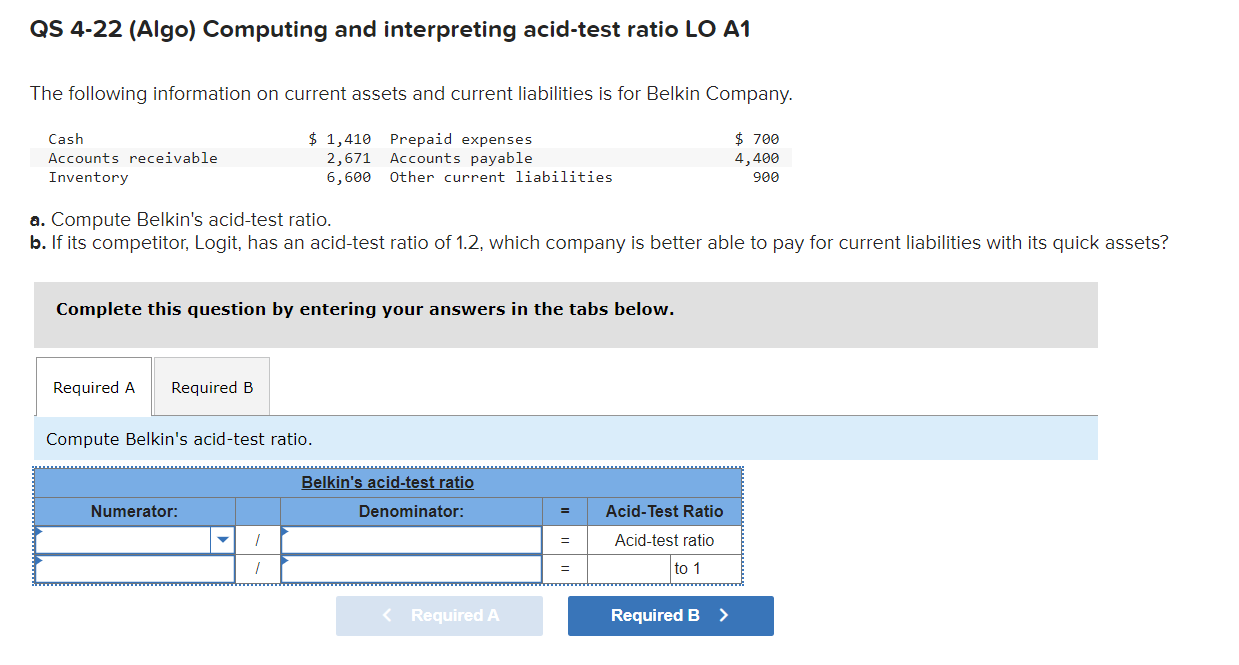

Question: QS 4-22 (Algo) Computing and interpreting acid-test ratio LO A1 The following information on current assets and current liabilities is for Belkin Company. a. Compute

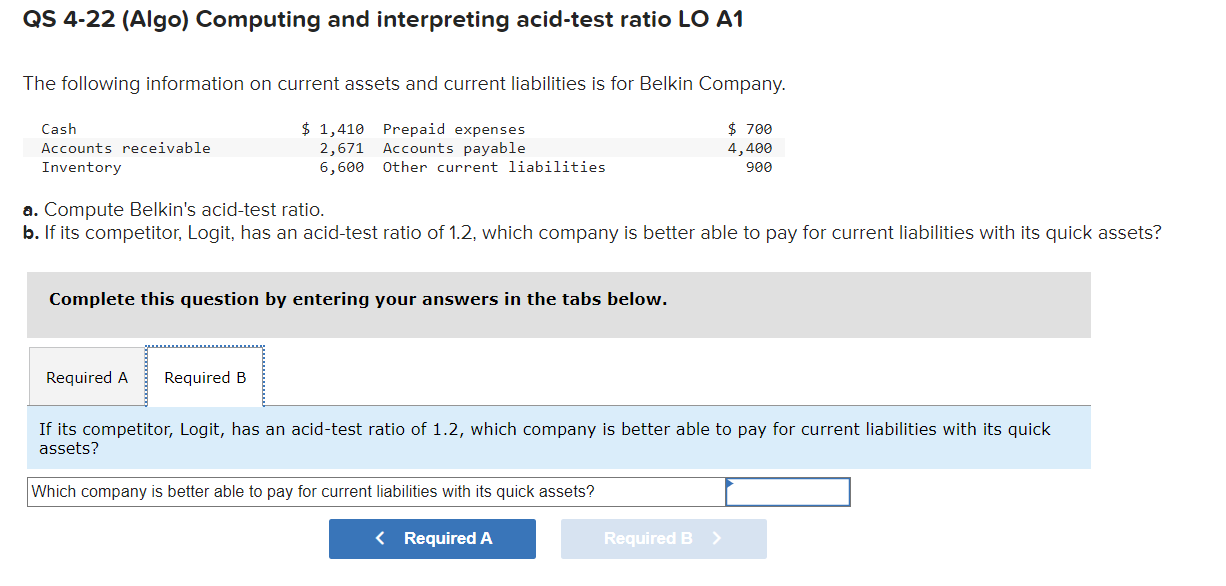

QS 4-22 (Algo) Computing and interpreting acid-test ratio LO A1 The following information on current assets and current liabilities is for Belkin Company. a. Compute Belkin's acid-test ratio. b. If its competitor, Logit, has an acid-test ratio of 1.2, which company is better able to pay for current liabilities with its quick assets? Complete this question by entering your answers in the tabs below. Compute Belkin's acid-test ratio. QS 4-22 (Algo) Computing and interpreting acid-test ratio LO A1 The following information on current assets and current liabilities is for Belkin Company. a. Compute Belkin's acid-test ratio. b. If its competitor, Logit, has an acid-test ratio of 1.2, which company is better able to pay for current liabilities with its quick assets? Complete this question by entering your answers in the tabs below. If its competitor, Logit, has an acid-test ratio of 1.2, which company is better able to pay for current liabilities with its quick assets? Which company is better able to pay for current liabilities with its quick assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts