Question: QS 8-5 Computing revised depreciation LO C2 On January 2, 2017, the Matthews Band acquires sound equipment for concert performances at a cost of $65,800.

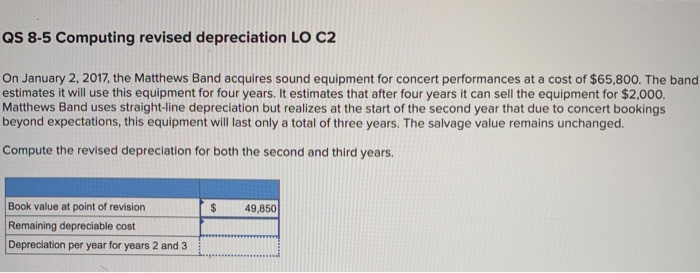

QS 8-5 Computing revised depreciation LO C2 On January 2, 2017, the Matthews Band acquires sound equipment for concert performances at a cost of $65,800. The band estimates it will use this equipment for four years. It estimates that after four years it can sell the equipment for $2,000. Matthews Band uses straight-line depreciation but realizes at the start of the second year that due to concert bookings beyond expectations, this equipment will last only a total of three years. The salvage value remains unchanged. Compute the revised depreciation for both the second and third years. $ 49,850 Book value at point of revision Remaining depreciable cost Depreciation per year for years 2 and 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts