Question: QS 9 - 6 ( Algo ) Computing net pay LO P 2 1 4 . 2 8 points Skipped eBook References At the end

QS Algo Computing net pay LO P

points

Skipped

eBook

References

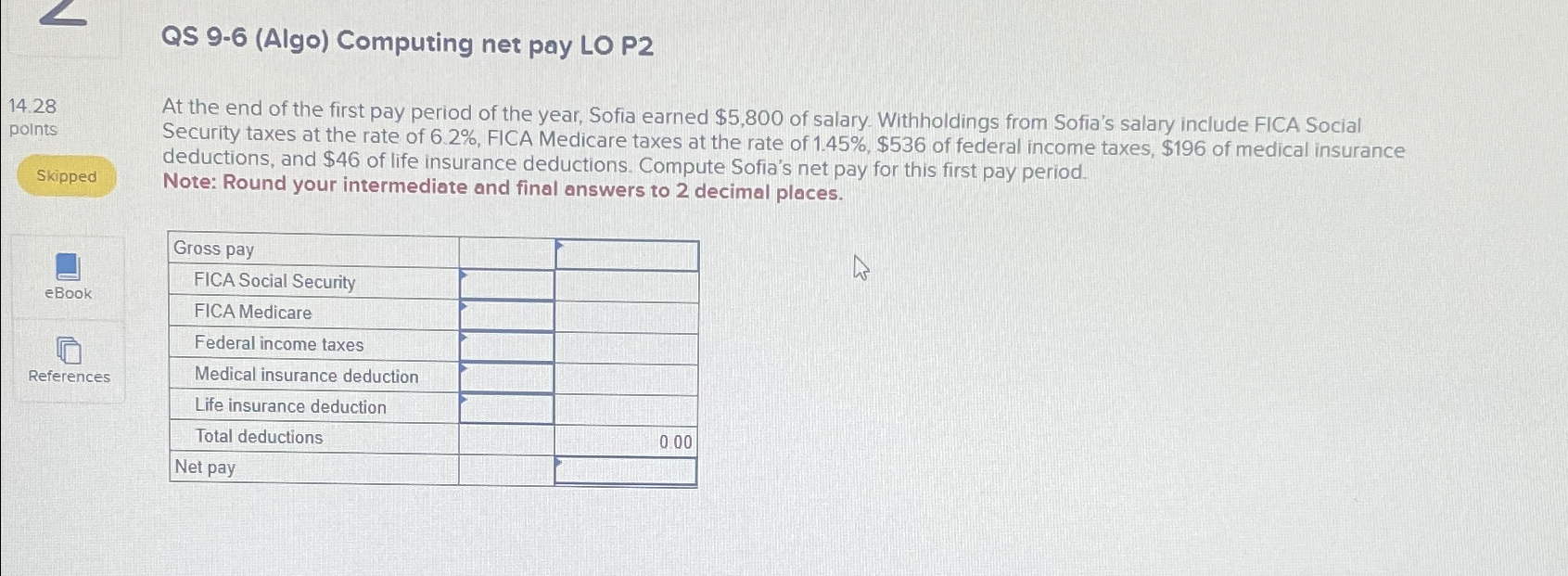

At the end of the first pay period of the year, Sofia earned $ of salary. Withholdings from Sofia's salary include FICA Social Security taxes at the rate of FICA Medicare taxes at the rate of $ of federal income taxes, $ of medical insurance deductions, and $ of life insurance deductions. Compute Sofia's net pay for this first pay period.

Note: Round your intermediate and final answers to decimal places.

tableGross pay,,FICA Social Security,,FICA Medicare,,Federal income taxes,,Medical insurance deduction,,Life insurance deduction,,Total deductions,,Net pay,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock