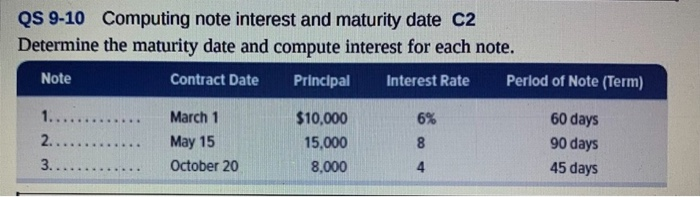

Question: QS 9-10 Computing note interest and maturity date C2 Determine the maturity date and compute interest for each note. Note Contract Date Principal Interest Rate

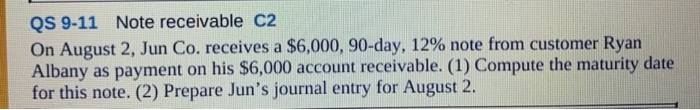

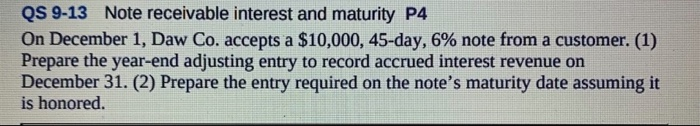

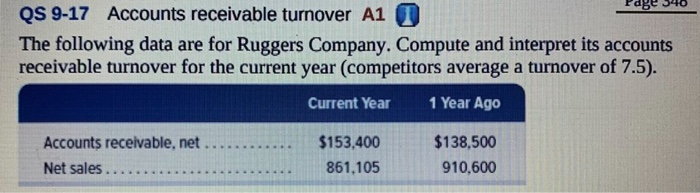

QS 9-10 Computing note interest and maturity date C2 Determine the maturity date and compute interest for each note. Note Contract Date Principal Interest Rate Period of Note (Term) 1............. 2. 3.. March 1 May 15 October 20 $10,000 15,000 8.000 6% 8 60 days 90 days 45 days 4 QS 9-11 Note receivable C2 On August 2, Jun Co. receives a $6,000, 90-day, 12% note from customer Ryan Albany as payment on his $6,000 account receivable. (1) Compute the maturity date for this note. (2) Prepare Jun's journal entry for August 2. QS 9-13 Note receivable interest and maturity P4 On December 1, Daw Co. accepts a $10,000, 45-day, 6% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31. (2) Prepare the entry required on the note's maturity date assuming it is honored. abe QS 9-17 Accounts receivable turnover A1 The following data are for Ruggers Company. Compute and interpret its accounts receivable turnover for the current year (competitors average a turnover of 7.5). Current Year 1 Year Ago Accounts receivable, net. Net sales. $153,400 861,105 $138,500 910,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts