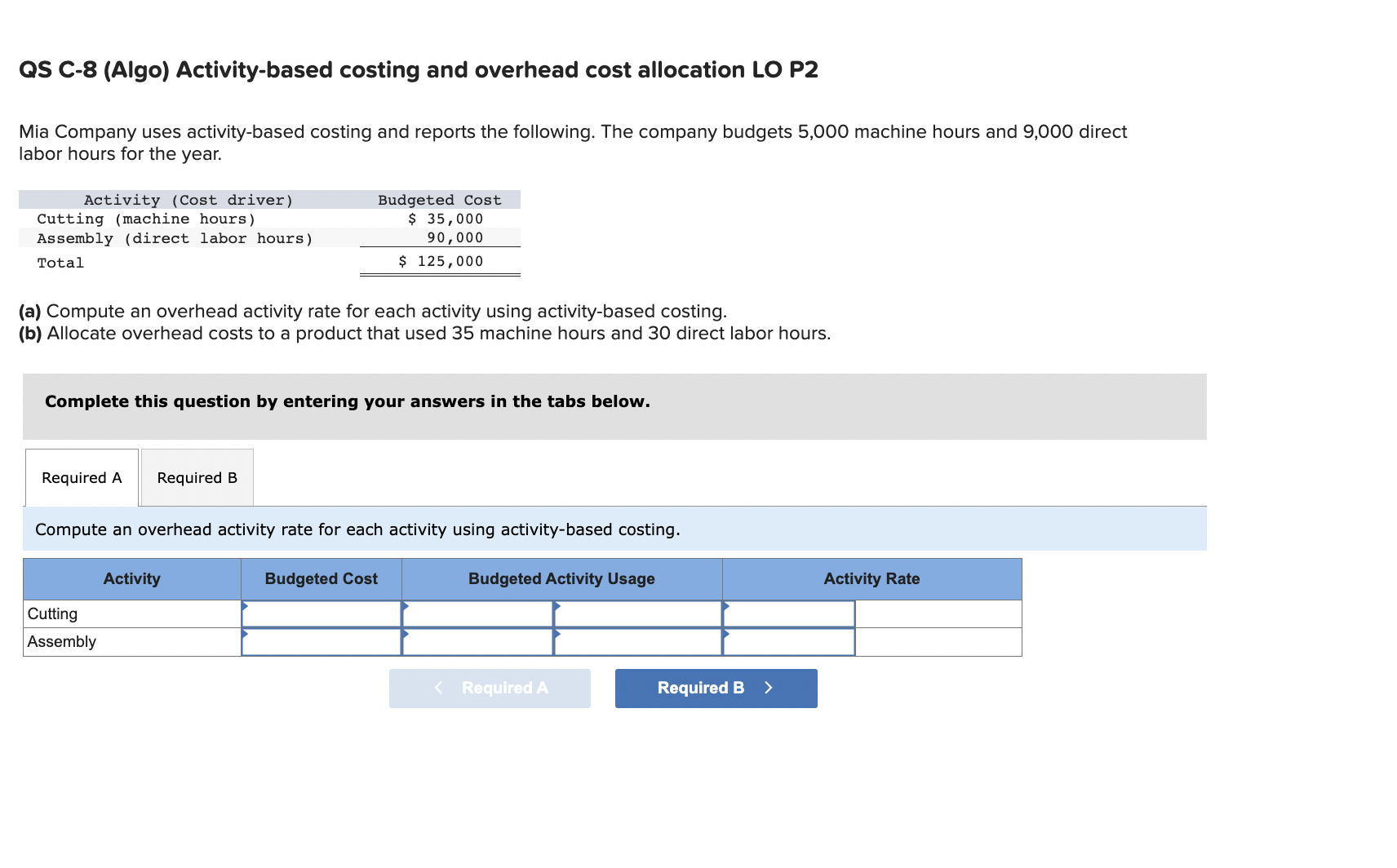

Question: QS C-8 (Algo) Activity-based costing and overhead cost allocation LO P2 Mia Company uses activity-based costing and reports the following. The company budgets 5,000 machine

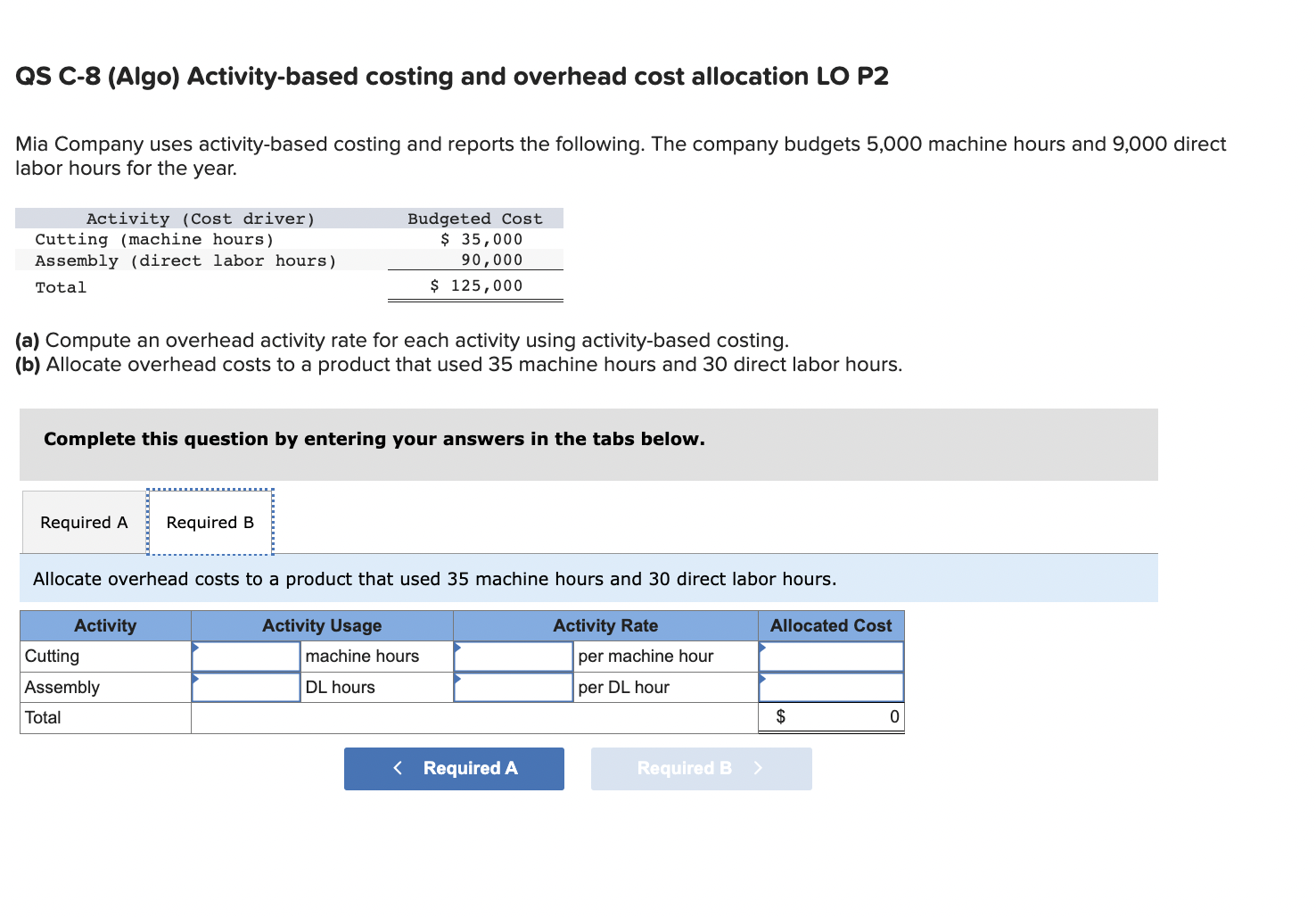

QS C-8 (Algo) Activity-based costing and overhead cost allocation LO P2 Mia Company uses activity-based costing and reports the following. The company budgets 5,000 machine hours and 9,000 direct labor hours for the year. (a) Compute an overhead activity rate for each activity using activity-based costing. (b) Allocate overhead costs to a product that used 35 machine hours and 30 direct labor hours. Complete this question by entering your answers in the tabs below. Compute an overhead activity rate for each activity using activity-based costing. QS C-8 (Algo) Activity-based costing and overhead cost allocation LO P2 Mia Company uses activity-based costing and reports the following. The company budgets 5,000 machine hours and 9,000 direct labor hours for the year. (a) Compute an overhead activity rate for each activity using activity-based costing. (b) Allocate overhead costs to a product that used 35 machine hours and 30 direct labor hours. Complete this question by entering your answers in the tabs below. Allocate overhead costs to a product that used 35 machine hours and 30 direct labor hours

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts