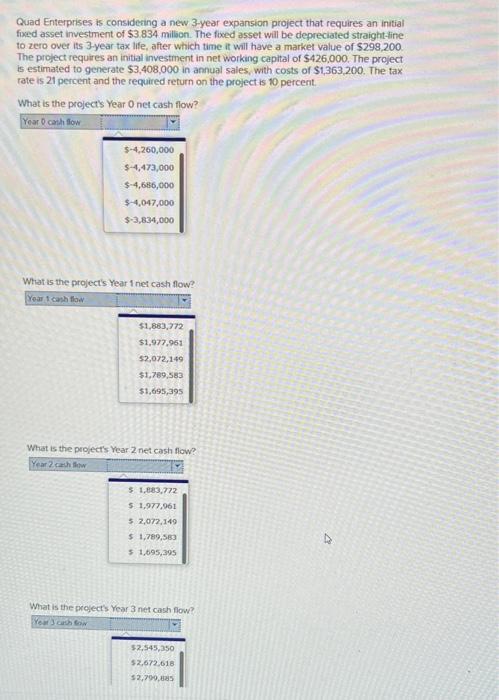

Question: Quad Enterprises is considecing a new 3-year expansion project that requires an initial fixed asset investment of $3.834 million. The foxed asset will be depreciated

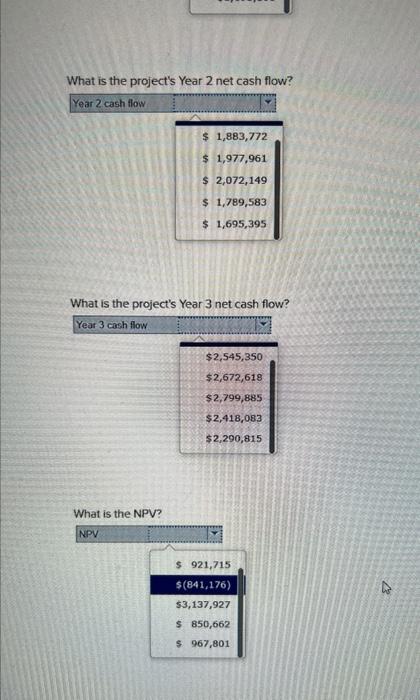

Quad Enterprises is considecing a new 3-year expansion project that requires an initial fixed asset investment of $3.834 million. The foxed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value of $299.200 The project requires an initial investment in net working capital of $426,000. The prolect is estimated to generate $3,408,000 in annual sales, with costs of $1,363,200. The tax rate is 21 percent and the required retum on the project is 10 percent What is the project's Year 0 net cash flow? What is the project's Year 1 net cash flow? Yoar 1 canh for What is the prolect's Year 2 net cach flow What is the provects Year 3 net cash fow? What is the project's Year 2 net cash flow? Year 2 cash flow $1,883,772$1,977,961$2,072,149$1,789,583$1,695,395 What is the project's Year 3 net cash flow? What is the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts