Question: Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be

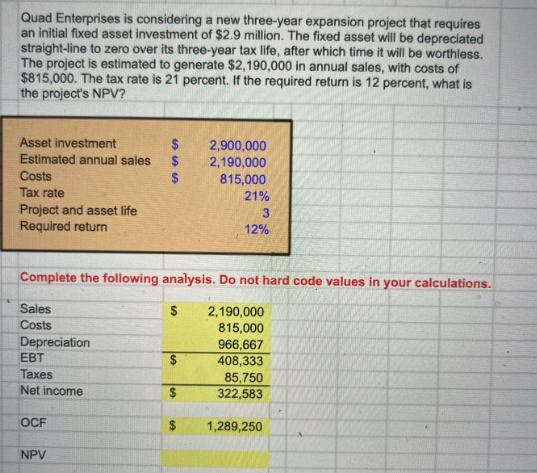

Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? Asset investment Estimated annual sales Costs Tax rate Project and asset life Required return Sales Costs Depreciation EBT Taxes Net income OCF 555 NPV $ $ Complete the following analysis. Do not hard code values in your calculations. 2,190,000 815,000 966,667 408,333 85,750 322,583 S $ $ 2,900,000 2,190,000 815,000 IA 21% 3 12% C 1,289,250

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Answer Solution less less less add YEAR annual sales costs depreciation EBT tax 21 EAT ... View full answer

Get step-by-step solutions from verified subject matter experts