Question: Quantifying the Effect of Inventory Write - offs on Ratios e . Use the adjusted cost of goods sold and inventory balances to recalculate inventory

Quantifying the Effect of Inventory Writeoffs on Ratios e Use the adjusted cost of goods sold and inventory balances to recalculate inventory turnover and days inventory outstanding. Did the inventory writeoff make a significant difference?

Note: Round answers to the nearest dollar, if applicable.

Note: Round answers to the nearest whole number, if applicable.

Days Inventory Outstanding DIO:

The writeoff

make a significant difference in the DIO metric.

respectively.

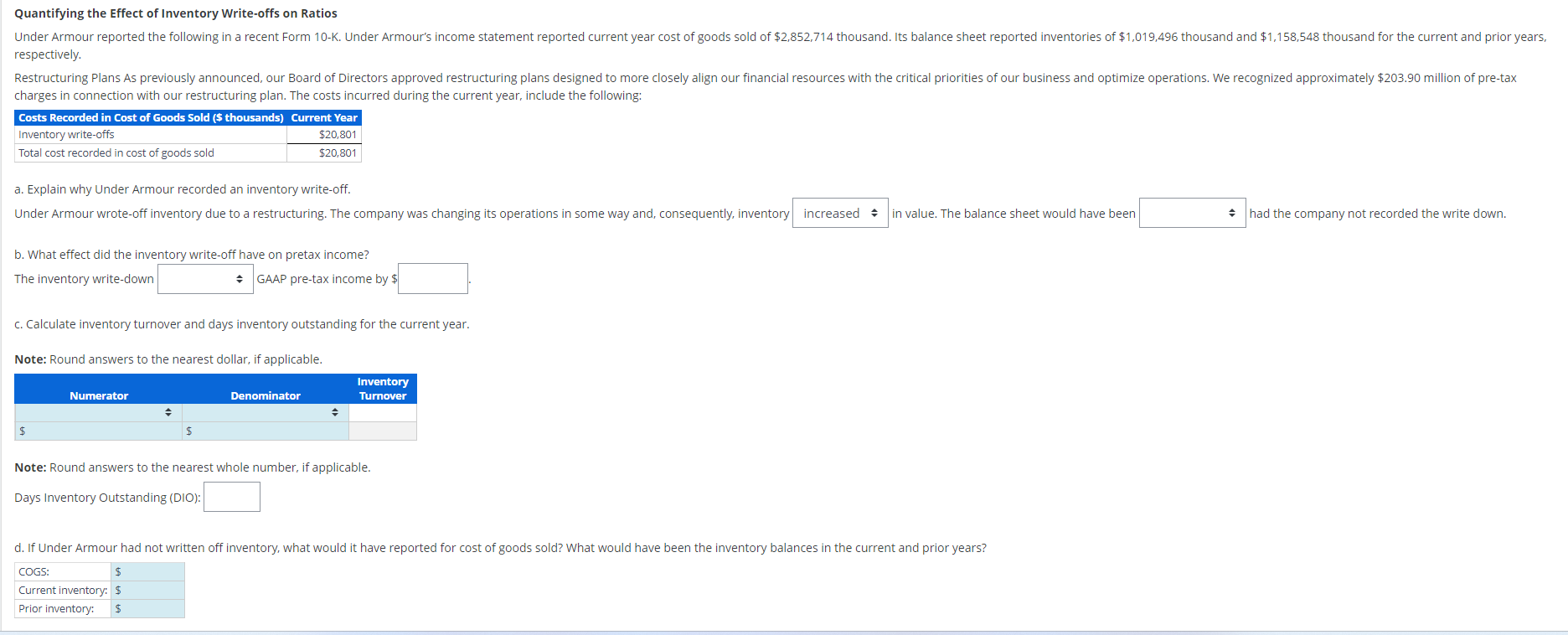

charges in connection with our restructuring plan. The costs incurred during the current year, include the following:

a Explain why Under Armour recorded an inventory writeoff.

Under Armour wroteoff inventory due to a restructuring. The company was changing its operations in some way and, consequently, inventory

in value. The balance sheet would have beer

had the company not recorded the write down.

b What effect did the inventory writeoff have on pretax income?

The inventory writedown

GAAP pretax income by $

c Calculate inventory turnover and days inventory outstanding for the current year.

Note: Round answers to the nearest dollar, if applicable.

Note: Round answers to the nearest whole number, if applicable.

Days Inventory Outstanding DIO:

d If Under Armour had not written off inventory, what would it have reported for cost of goods sold? What would have been the inventory balances in the current and prior years?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock