Question: Quantitative analysis ( I need a professional to solve this ) thank you Modern portfolio theory concerns the construction of an investment portfolio. In other

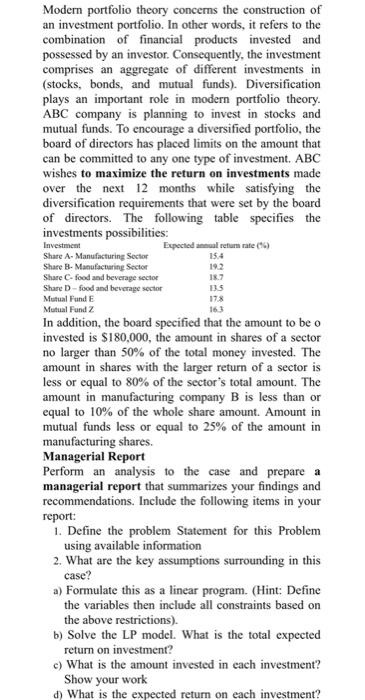

Modern portfolio theory concerns the construction of an investment portfolio. In other words, it refers to the combination of financial products invested and possessed by an investor. Consequently, the investment comprises an aggregate of different investments in (stocks, bonds, and mutual funds). Diversification plays an important role in modern portfolio theory. ABC company is planning to invest in stocks and mutual funds. To encourage a diversified portfolio, the board of directors has placed limits on the amount that can be committed to any one type of investment. ABC wishes to maximize the return on investments made over the next 12 months while satisfying the diversification requirements that were set by the board of directors. The following table specifies the investments possibilities: In addition, the board specified that the amount to be o invested is $180,000, the amount in shares of a sector no larger than 50% of the total money invested. The amount in shares with the larger return of a sector is less or equal to 80% of the sector's total amount. The amount in manufacturing company B is less than or equal to 10% of the whole share amount. Amount in mutual funds less or equal to 25% of the amount in manufacturing shares. Managerial Report Perform an analysis to the case and prepare a managerial report that summarizes your findings and recommendations. Include the following items in your report: 1. Define the problem Statement for this Problem using available information 2. What are the key assumptions surrounding in this case? a) Formulate this as a linear program. (Hint: Define the variables then include all constraints based on the above restrictions). b) Solve the LP model. What is the total expected return on investment? c) What is the amount invested in each investment? Show your work d) What is the expected return on each investment? manufacturing shares. Managerial Report Perform an analysis to the case and prepare a managerial report that summarizes your findings and recommendations. Include the following items in your report: 1. Define the problem Statement for this Problem using available information 2. What are the key assumptions surrounding in this case? a) Formulate this as a linear program. (Hint: Define the variables then include all constraints based on the above restrictions). b) Solve the LP model. What is the total expected return on investment? c) What is the amount invested in each investment? Show your work d) What is the expected return on each investment? Show your work 3. What are your recommendations? 4. 4. Include details of your analysis (using QM for windows or Excel QM) as an appendix. Don't include any output in the body of the report. Name ID Solution: Objective: Constraints

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts