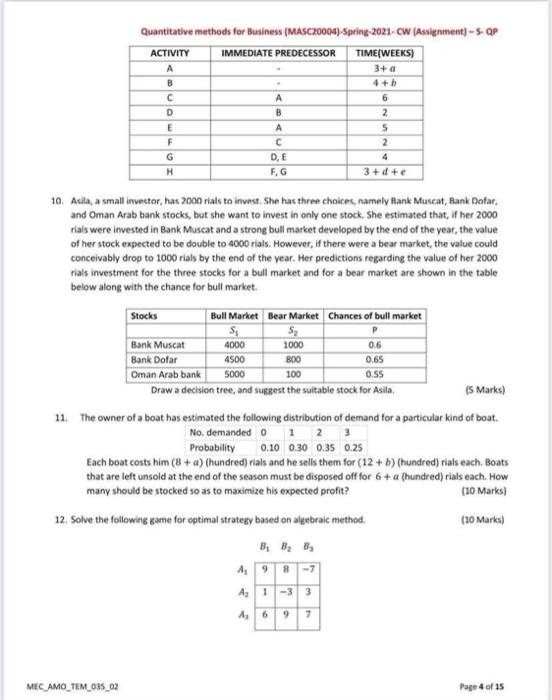

Question: Quantitative methods for Business (MASC20004)-Spring-2021-CW (Assignment) --- OP IMMEDIATE PREDECESSOR TIME(WEEKS) A 3+ a 4 + b ACTIVITY B C D E F G A

Quantitative methods for Business (MASC20004)-Spring-2021-CW (Assignment) --- OP IMMEDIATE PREDECESSOR TIME(WEEKS) A 3+ a 4 + b ACTIVITY B C D E F G A B DE F.G 6 2 5 2 3+d+e 10. Asila, a small investor, has 2000 rials to invest. She has three choices, namely Bank Muscat, Rank Dofar, and Oman Arab bank stocks, but she want to invest in only one stock. She estimated that, if her 2000 rials were invested in Bank Muscat and a strong bull market developed by the end of the year, the value of her stock expected to be double to 4000 rials. However, if there were a bear market, the value could conceivably drop to 1000 rials by the end of the year. Her predictions regarding the value of her 2000 rials investment for the three stocks for a bull market and for a bear market are shown in the table below along with the chance for bull market. 4000 Stocks Bull Market Bear Market Chances of bull market S; Sz P Bank Muscat 1000 0.6 Bank Dofar 4500 800 0.65 Oman Arab bank 5000 100 0.55 Draw a decision tree, and suggest the suitable stock for Asila. (Marks) 11. The owner of a boat has estimated the following distribution of demand for a particular kind of boat. No. demanded 0 1 2 3 Probability 0.10 0.30 0.35 0.25 Each boat costs him (8 + a) (hundred) rials and he sells them for (12 + b) (hundred)rials each. Boats that are left unsold at the end of the season must be disposed off for 6+a (hundred) rials each. How many should be stocked so as to maximize his expected profit? (10 Marks) 12. Solve the following game for optimal strategy based on algebraic method. (10 Marks) A, 1 -3 3 A 69 7 MEC_AMO_TEM_035_02 Page 4 of 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts